Tax Documents

Tax1120SK1

FDX / Data Structures / Tax1120SK1

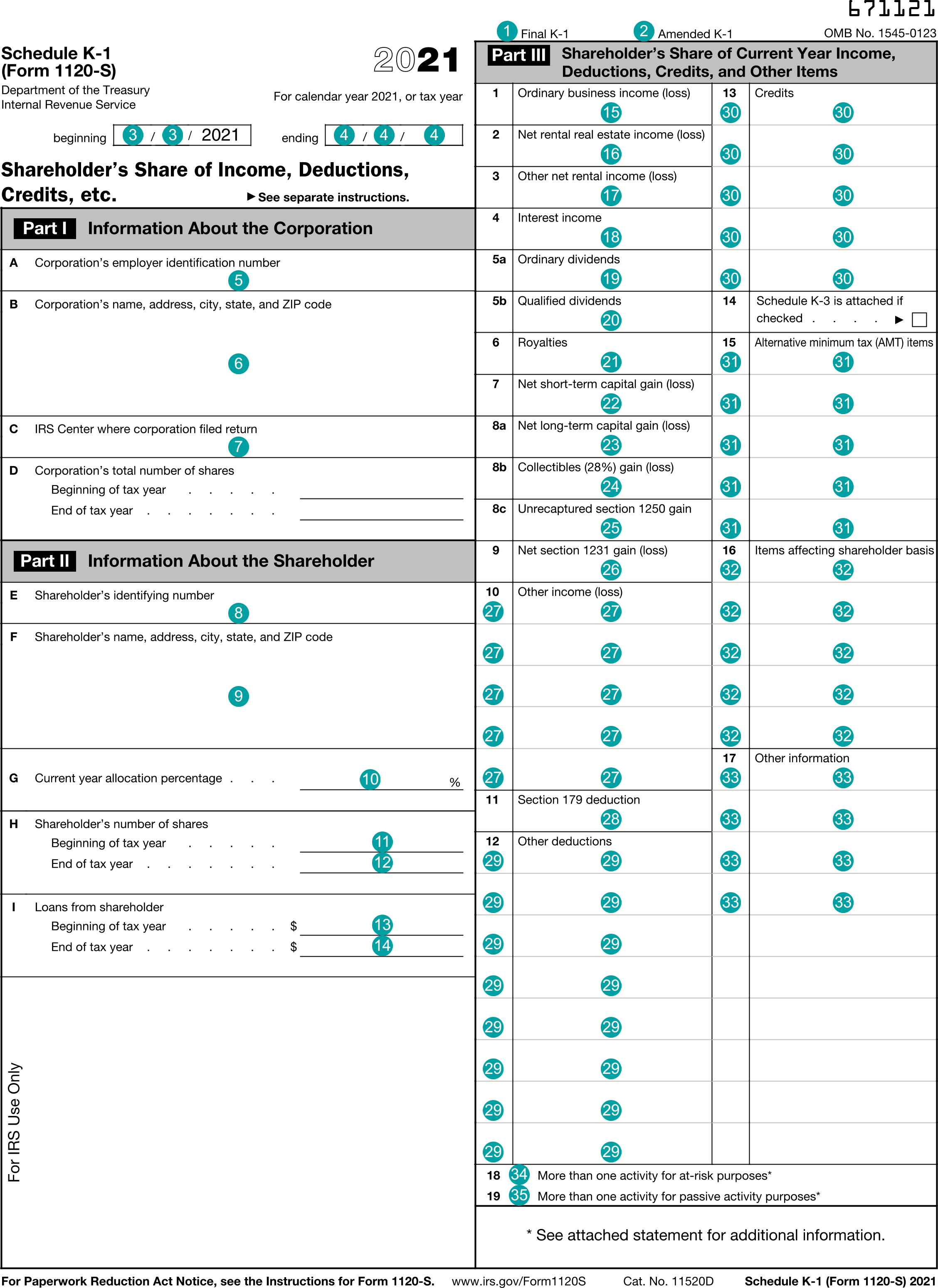

Form 1120-S K-1, Shareholder's Share of Income, Deductions, Credits, etc.

Extends and inherits all fields from Tax

Tax1120SK1 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | finalK1 | boolean | Final K-1 |

| 2 | amendedK1 | boolean | Amended K-1 |

| 3 | fiscalYearBegin | DateString | Fiscal year begin date |

| 4 | fiscalYearEnd | DateString | Fiscal year end date |

| 5 | corporationTin | string | Box A, Corporation's employer identification number |

| 6 | corporationNameAddress | NameAddress | Box B, Corporation's name, address, city, state, and ZIP code |

| 7 | irsCenter | string | Box C, IRS Center where corporation filed return |

| 8 | corporationBeginningShares | number (double) | Box D, Corporation's total number of shares, Beginning of tax year |

| 9 | corporationEndingShares | number (double) | Box D, Corporation's total number of shares, End of tax year |

| 10 | shareholderTin | string | Box E, Shareholder's identifying number |

| 11 | shareholderNameAddress | NameAddress | Box F, Shareholder's name, address, city, state, and ZIP code |

| 12 | percentOwnership | number (double) | Box G, Current year allocation percentage |

| 13 | beginningShares | number (double) | Box H, Shareholder's number of shares, Beginning of tax year |

| 14 | endingShares | number (double) | Box H, Shareholder's number of shares, End of tax year |

| 15 | beginningLoans | number (double) | Box I, Loans from shareholder, Beginning of tax year |

| 16 | endingLoans | number (double) | Box I, Loans from shareholder, Ending of tax year |

| 17 | ordinaryIncome | number (double) | Box 1, Ordinary business income (loss) |

| 18 | netRentalRealEstateIncome | number (double) | Box 2, Net rental real estate income (loss) |

| 19 | otherRentalIncome | number (double) | Box 3, Other net rental income (loss) |

| 20 | interestIncome | number (double) | Box 4, Interest income |

| 21 | ordinaryDividends | number (double) | Box 5a, Ordinary dividends |

| 22 | qualifiedDividends | number (double) | Box 5b, Qualified dividends |

| 23 | royalties | number (double) | Box 6, Royalties |

| 24 | netShortTermGain | number (double) | Box 7, Net short-term capital gain (loss) |

| 25 | netLongTermGain | number (double) | Box 8a, Net long-term capital gain (loss) |

| 26 | collectiblesGain | number (double) | Box 8b, Collectibles (28%) gain (loss) |

| 27 | unrecaptured1250Gain | number (double) | Box 8c, Unrecaptured section 1250 gain |

| 28 | net1231Gain | number (double) | Box 9, Net section 1231 gain (loss) |

| 29 | otherIncome | Array of CodeAmount | Box 10, Other income (loss) |

| 30 | section179Deduction | number (double) | Box 11, Section 179 deduction |

| 31 | otherDeductions | Array of CodeAmount | Box 12, Other deductions |

| 32 | credits | Array of CodeAmount | Box 13, Credits |

| 33 | scheduleK3 | boolean | Box 14, Schedule K-3 is attached |

| 34 | foreignTransactions | Array of CodeAmount | Box 14, Foreign transactions. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 35 | foreignCountry | string | Box 14, Foreign country. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 36 | amtItems | Array of CodeAmount | Box 15, Alternative minimum tax (AMT) items |

| 37 | basisItems | Array of CodeAmount | Box 16, Items affecting shareholder basis |

| 38 | otherInfo | Array of CodeAmount | Box 17, Other information |

| 39 | multipleAtRiskActivities | boolean | Box 18, More than one activity for at-risk purposes |

| 40 | multiplePassiveActivities | boolean | Box 19, More than one activity for passive activity purposes |

Tax1120SK1 Usage:

- TaxData tax1120SK1

FDX Data Structure as JSON

{

"tax1120SK1" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"finalK1" : true,

"amendedK1" : true,

"fiscalYearBegin" : "2020-07-01",

"fiscalYearEnd" : "2020-07-01",

"corporationTin" : "string",

"corporationNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"irsCenter" : "string",

"shareholderTin" : "string",

"shareholderNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"percentOwnership" : 0.0,

"beginningShares" : 0.0,

"endingShares" : 0.0,

"beginningLoans" : 0.0,

"endingLoans" : 0.0,

"ordinaryIncome" : 0.0,

"netRentalRealEstateIncome" : 0.0,

"otherRentalIncome" : 0.0,

"interestIncome" : 0.0,

"ordinaryDividends" : 0.0,

"qualifiedDividends" : 0.0,

"royalties" : 0.0,

"netShortTermGain" : 0.0,

"netLongTermGain" : 0.0,

"collectiblesGain" : 0.0,

"unrecaptured1250Gain" : 0.0,

"net1231Gain" : 0.0,

"otherIncome" : [ {

"code" : "string",

"amount" : 0.0

} ],

"section179Deduction" : 0.0,

"otherDeductions" : [ {

"code" : "string",

"amount" : 0.0

} ],

"credits" : [ {

"code" : "string",

"amount" : 0.0

} ],

"foreignTransactions" : [ {

"code" : "string",

"amount" : 0.0

} ],

"foreignCountry" : "string",

"amtItems" : [ {

"code" : "string",

"amount" : 0.0

} ],

"basisItems" : [ {

"code" : "string",

"amount" : 0.0

} ],

"otherInfo" : [ {

"code" : "string",

"amount" : 0.0

} ],

"multipleAtRiskActivities" : true,

"multiplePassiveActivities" : true

}

}

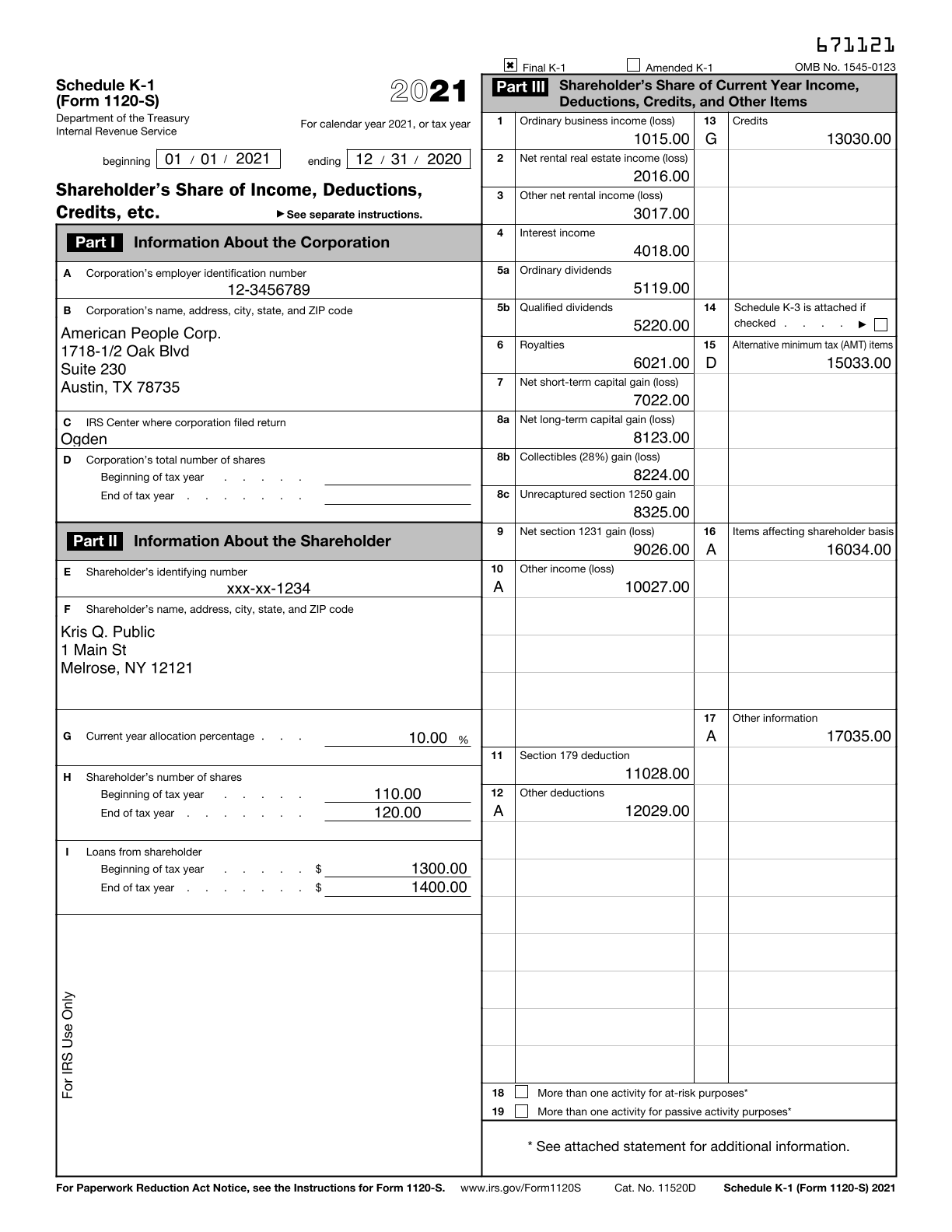

Example Form PDF

Example Form JSON

{

"tax1120SK1" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1120SK1",

"finalK1" : true,

"fiscalYearBegin" : "2020-01-01",

"fiscalYearEnd" : "2020-12-31",

"corporationTin" : "12-3456789",

"corporationNameAddress" : {

"line1" : "1718-1/2 Oak Blvd",

"line2" : "Suite 230",

"city" : "Austin",

"state" : "TX",

"postalCode" : "78735",

"name1" : "American People Corp."

},

"irsCenter" : "Ogden",

"shareholderTin" : "xxx-xx-1234",

"shareholderNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"percentOwnership" : 10.0,

"beginningShares" : 110.0,

"endingShares" : 120.0,

"beginningLoans" : 1300.0,

"endingLoans" : 1400.0,

"ordinaryIncome" : 1015.0,

"netRentalRealEstateIncome" : 2016.0,

"otherRentalIncome" : 3017.0,

"interestIncome" : 4018.0,

"ordinaryDividends" : 5119.0,

"qualifiedDividends" : 5220.0,

"royalties" : 6021.0,

"netShortTermGain" : 7022.0,

"netLongTermGain" : 8123.0,

"collectiblesGain" : 8224.0,

"unrecaptured1250Gain" : 8325.0,

"net1231Gain" : 9026.0,

"otherIncome" : [ {

"code" : "A",

"amount" : 10027.0

} ],

"section179Deduction" : 11028.0,

"otherDeductions" : [ {

"code" : "A",

"amount" : 12029.0

} ],

"credits" : [ {

"code" : "G",

"amount" : 13030.0

} ],

"foreignTransactions" : [ {

"code" : "C",

"amount" : 14032.0

} ],

"foreignCountry" : "Mexico",

"amtItems" : [ {

"code" : "D",

"amount" : 15033.0

} ],

"basisItems" : [ {

"code" : "A",

"amount" : 16034.0

} ],

"otherInfo" : [ {

"code" : "A",

"amount" : 17035.0

} ],

"multipleAtRiskActivities" : true,

"multiplePassiveActivities" : false

}

}

Example Form JSON for QR Code Purposes

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1120SK1",

"finalK1": "true",

"fiscalYearBegin": "2020-01-01",

"fiscalYearEnd": "2020-12-31",

"corporationTin": "12-3456789",

"corporationNameAddress.line1": "1718-1/2 Oak Blvd",

"corporationNameAddress.line2": "Suite 230",

"corporationNameAddress.city": "Austin",

"corporationNameAddress.state": "TX",

"corporationNameAddress.postalCode": "78735",

"corporationNameAddress.name1": "American People Corp.",

"irsCenter": "Ogden",

"shareholderTin": "xxx-xx-1234",

"shareholderNameAddress.line1": "1 Main St",

"shareholderNameAddress.city": "Melrose",

"shareholderNameAddress.state": "NY",

"shareholderNameAddress.postalCode": "12121",

"shareholderNameAddress.name1": "Kris Q. Public",

"percentOwnership": "10.0",

"beginningShares": "110.0",

"endingShares": "120.0",

"beginningLoans": "1300.0",

"endingLoans": "1400.0",

"ordinaryIncome": "1015.0",

"netRentalRealEstateIncome": "2016.0",

"otherRentalIncome": "3017.0",

"interestIncome": "4018.0",

"ordinaryDividends": "5119.0",

"qualifiedDividends": "5220.0",

"royalties": "6021.0",

"netShortTermGain": "7022.0",

"netLongTermGain": "8123.0",

"collectiblesGain": "8224.0",

"unrecaptured1250Gain": "8325.0",

"net1231Gain": "9026.0",

"otherIncome-1.code": "A",

"otherIncome-1.amount": "10027.0",

"section179Deduction": "11028.0",

"otherDeductions-1.code": "A",

"otherDeductions-1.amount": "12029.0",

"credits-1.code": "G",

"credits-1.amount": "13030.0",

"foreignTransactions-1.code": "C",

"foreignTransactions-1.amount": "14032.0",

"foreignCountry": "Mexico",

"amtItems-1.code": "D",

"amtItems-1.amount": "15033.0",

"basisItems-1.code": "A",

"basisItems-1.amount": "16034.0",

"otherInfo-1.code": "A",

"otherInfo-1.amount": "17035.0",

"multipleAtRiskActivities": "true",

"multiplePassiveActivities": "false"

}