Tax Documents

Tax2439

FDX / Data Structures / Tax2439

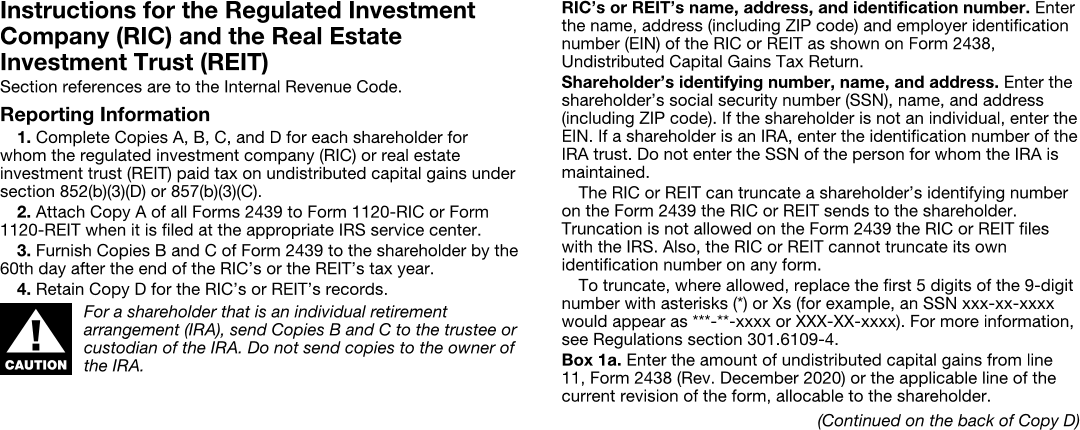

Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains

Extends and inherits all fields from Tax

Tax2439 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | fiscalYearBegin | DateString | Fiscal year begin date |

| 2 | fiscalYearEnd | DateString | Fiscal year end date |

| 3 | ricOrReitNameAddress | NameAddressPhone | RIC or REIT's name, address and phone |

| 4 | ricOrReitTin | string | Identification number of RIC or REIT |

| 5 | shareholderNameAddress | NameAddress | Shareholder's address |

| 6 | shareholderTin | string | Shareholder's identifying number |

| 7 | undistributedLongTermCapitalGains | number (double) | Box 1a, Total undistributed long-term capital gains |

| 8 | unrecaptured1250Gain | number (double) | Box 1b, Unrecaptured section 1250 gain |

| 9 | section1202Gain | number (double) | Box 1c, Section 1202 gain |

| 10 | collectiblesGain | number (double) | Box 1d, Collectibles (28%) gain |

| 11 | taxPaid | number (double) | Box 2, Tax paid by the RIC or REIT on the box 1a gains |

Tax2439 Usage:

- TaxData tax2439

FDX Data Structure as JSON

{

"tax2439" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"fiscalYearBegin" : "2020-07-01",

"fiscalYearEnd" : "2020-07-01",

"ricOrReitNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"ricOrReitTin" : "string",

"shareholderNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"shareholderTin" : "string",

"undistributedLongTermCapitalGains" : 0.0,

"unrecaptured1250Gain" : 0.0,

"section1202Gain" : 0.0,

"collectiblesGain" : 0.0,

"taxPaid" : 0.0

}

}

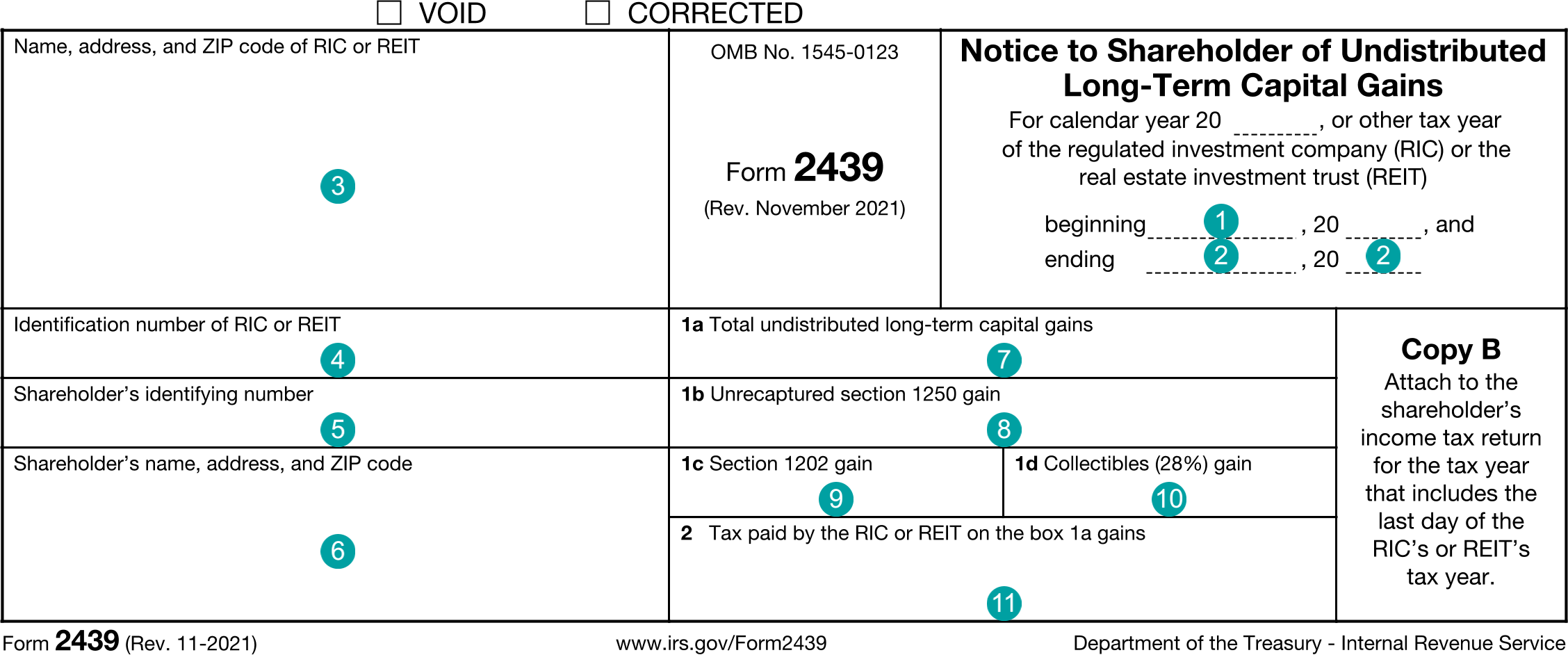

Example Form PDF

Example Form JSON

{

"tax2439" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax2439",

"ricOrReitNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"ricOrReitTin" : "12-3456789",

"shareholderNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"shareholderTin" : "xxx-xx-1234",

"undistributedLongTermCapitalGains" : 1100.0,

"unrecaptured1250Gain" : 120.0,

"section1202Gain" : 130.0,

"collectiblesGain" : 140.0,

"taxPaid" : 200.0

}

}

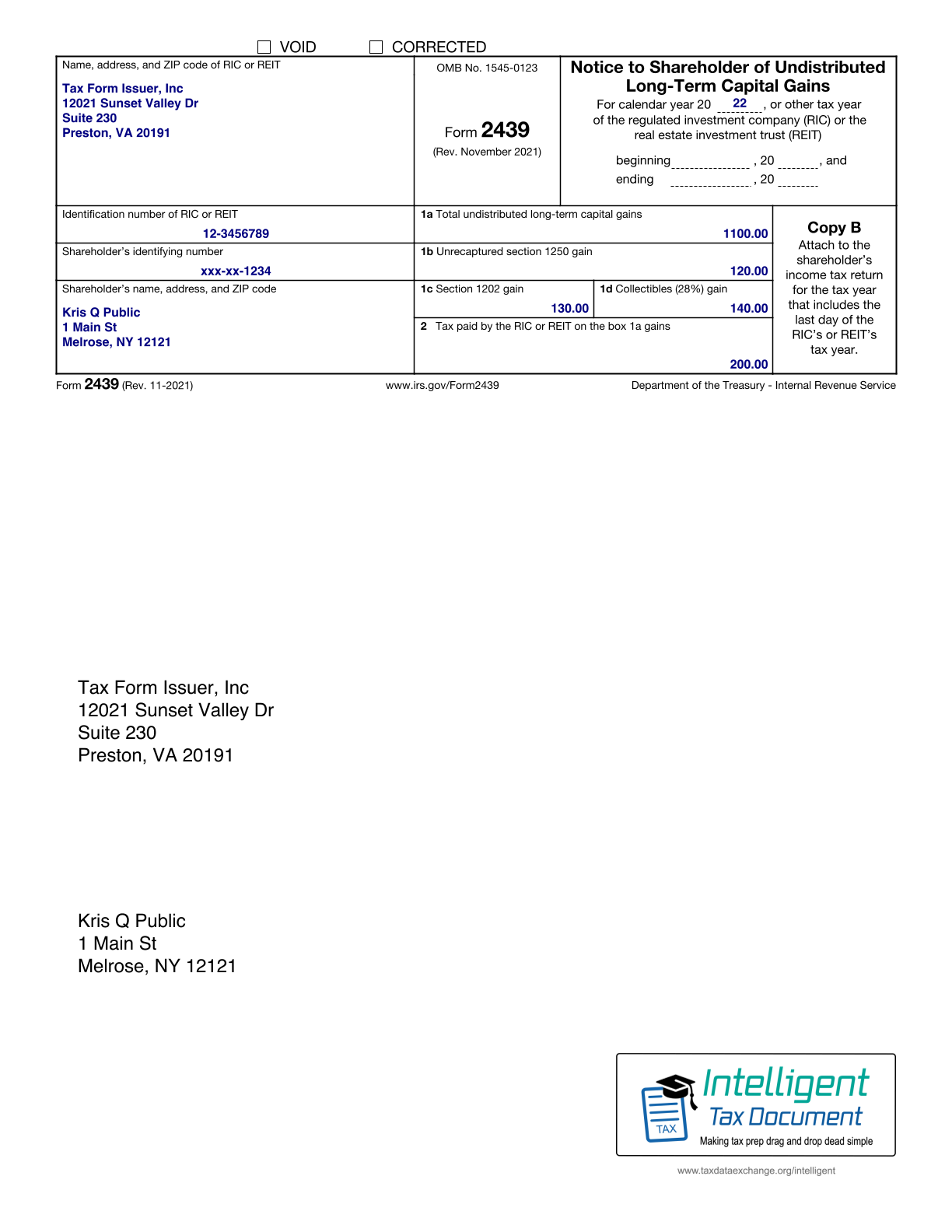

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax2439",

"ricOrReitNameAddress.line1": "12021 Sunset Valley Dr",

"ricOrReitNameAddress.line2": "Suite 230",

"ricOrReitNameAddress.city": "Preston",

"ricOrReitNameAddress.state": "VA",

"ricOrReitNameAddress.postalCode": "20191",

"ricOrReitNameAddress.country": "US",

"ricOrReitNameAddress.name1": "Tax Form Issuer, Inc",

"ricOrReitNameAddress.phone.number": "8885551212",

"ricOrReitTin": "12-3456789",

"shareholderNameAddress.line1": "1 Main St",

"shareholderNameAddress.city": "Melrose",

"shareholderNameAddress.state": "NY",

"shareholderNameAddress.postalCode": "12121",

"shareholderNameAddress.country": "US",

"shareholderNameAddress.name1": "Kris Q Public",

"shareholderTin": "xxx-xx-1234",

"undistributedLongTermCapitalGains": "1100.0",

"unrecaptured1250Gain": "120.0",

"section1202Gain": "130.0",

"collectiblesGain": "140.0",

"taxPaid": "200.0"

}

Issuer Instructions