Tax Documents

Tax1099B

FDX / Data Structures / Tax1099B

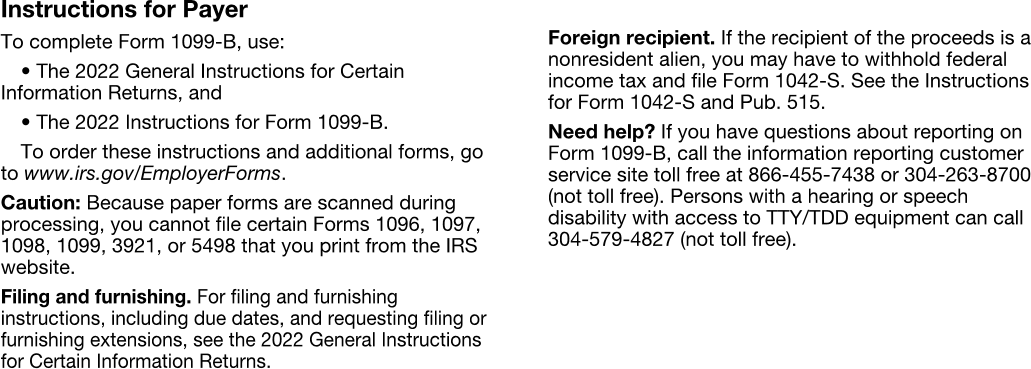

Form 1099-B, Proceeds From Broker and Barter Exchange Transactions

Extends and inherits all fields from Tax

Tax1099B Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | Payer's federal identification number |

| 3 | recipientTin | string | Recipient's identification number |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 14-16, State tax withholding |

| 7 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 8 | profitOnClosedContracts | number (double) | Box 8, Profit or (loss) realized in current year on closed contracts |

| 9 | unrealizedProfitOpenContractsBegin | number (double) | Box 9, Unrealized profit or loss on open contracts at end of last year |

| 10 | unrealizedProfitOpenContractsEnd | number (double) | Box 10, Unrealized profit or loss on open contracts at end of current year |

| 11 | aggregateProfitOnContracts | number (double) | Box 11, Aggregate profit or (loss) on contracts |

| 12 | bartering | number (double) | Box 13, Bartering |

| 13 | securityDetails | Array of SecurityDetail | Boxes 1-3, 5-7, 12, Security details |

| 14 | secondTinNotice | boolean | Second TIN Notice |

Tax1099B Usage:

- TaxData tax1099B

FDX Data Structure as JSON

{

"tax1099B" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"federalTaxWithheld" : 0.0,

"profitOnClosedContracts" : 0.0,

"unrealizedProfitOpenContractsBegin" : 0.0,

"unrealizedProfitOpenContractsEnd" : 0.0,

"aggregateProfitOnContracts" : 0.0,

"bartering" : 0.0,

"securityDetails" : [ {

"checkboxOnForm8949" : "string",

"securityName" : "string",

"numberOfShares" : 0.0,

"saleDescription" : "string",

"dateAcquired" : "2020-07-01",

"variousDatesAcquired" : true,

"dateOfSale" : "2020-07-01",

"salesPrice" : 0.0,

"accruedMarketDiscount" : 0.0,

"adjustmentCodes" : [ {

"code" : "string",

"amount" : 0.0

} ],

"costBasis" : 0.0,

"washSaleLossDisallowed" : 0.0,

"longOrShort" : "LONG",

"ordinary" : true,

"collectible" : true,

"qof" : true,

"federalTaxWithheld" : 0.0,

"noncoveredSecurity" : true,

"grossOrNet" : "GROSS",

"lossNotAllowed" : true,

"basisReported" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"cusip" : "string",

"foreignAccountTaxCompliance" : true

} ],

"secondTinNotice" : true

}

}

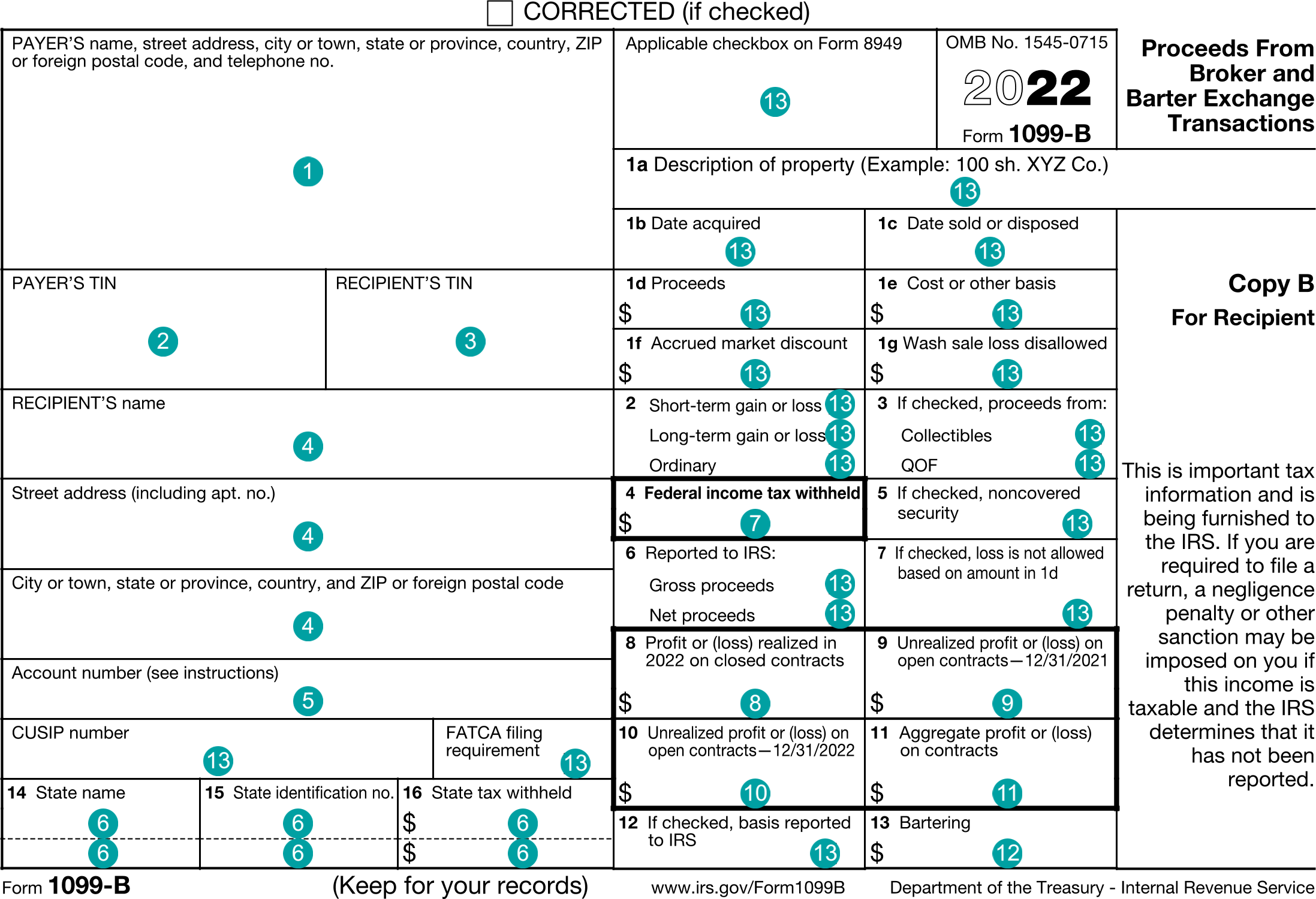

Example Form PDF

Example Form JSON

{

"tax1099B" : {

"taxYear" : 2021,

"taxFormDate" : "2022-02-01",

"additionalInformation" : "FDX v5.0",

"taxFormType" : "Tax1099B",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"payerTin" : "12-3456789",

"recipientTin" : "XXX-XX-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"accountNumber" : "123-1234567",

"securityDetails" : [ {

"checkboxOnForm8949" : "A",

"securityName" : "AAPL-Apple",

"numberOfShares" : 100.0,

"saleDescription" : "TODO: Create example details for different transactions and adjustmentCodes",

"dateAcquired" : "2019-07-01",

"variousDatesAcquired" : true,

"dateOfSale" : "2020-12-01",

"salesPrice" : 1400.0,

"accruedMarketDiscount" : 0.0,

"adjustmentCodes" : [ {

"code" : "B",

"amount" : 10.0

} ],

"costBasis" : 1500.0,

"correctedCostBasis" : 1500.0,

"washSaleLossDisallowed" : 140.0,

"longOrShort" : "LONG",

"ordinary" : true,

"collectible" : false,

"qof" : false,

"federalTaxWithheld" : 0.0,

"noncoveredSecurity" : false,

"grossOrNet" : "NET",

"lossNotAllowed" : true,

"basisReported" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "NY",

"stateTaxId" : "012345678",

"stateIncome" : 0.0

} ],

"cusip" : "037833100",

"foreignAccountTaxCompliance" : true,

"expiredOption" : "PURCHASED",

"investmentSaleType" : "OTHER"

} ]

}

}

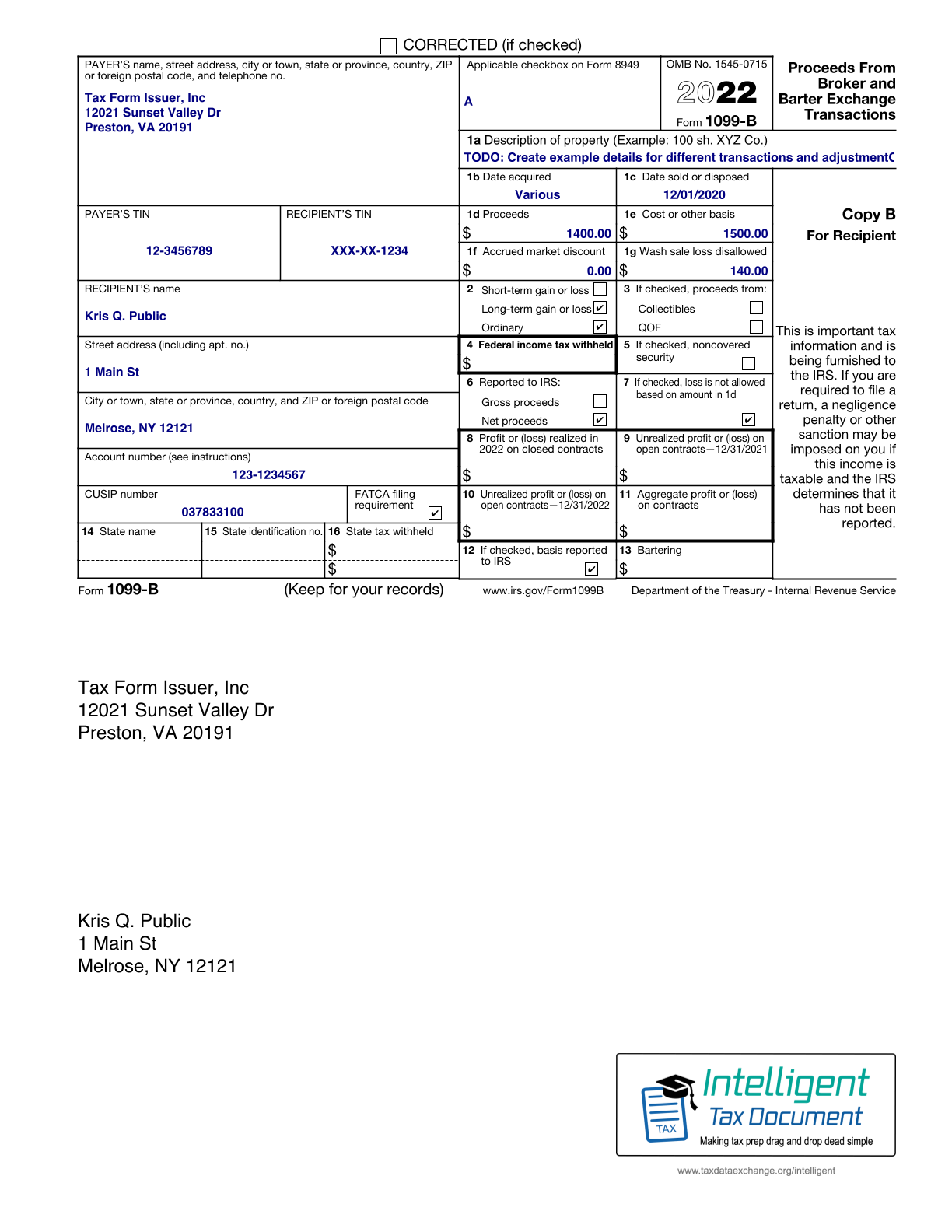

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Issuer Instructions