Tax Documents

Tax1099G

FDX / Data Structures / Tax1099G

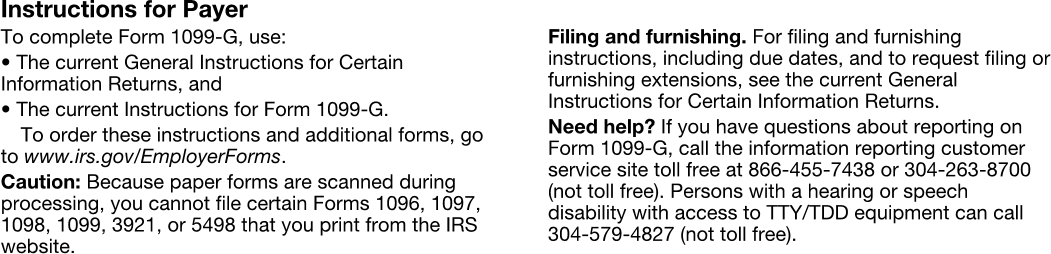

Form 1099-G, Certain Government Payments

Extends and inherits all fields from Tax

Tax1099G Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | unemploymentCompensation | number (double) | Box 1, Unemployment compensation |

| 7 | taxRefund | number (double) | Box 2, State or local income tax refunds, credits, or offsets |

| 8 | refundYear | integer | Box 3, Box 2 amount is for tax year |

| 9 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 10 | rtaaPayments | number (double) | Box 5, RTAA payments |

| 11 | grants | number (double) | Box 6, Taxable grants |

| 12 | agriculturePayments | number (double) | Box 7, Agriculture payments |

| 13 | businessIncome | boolean | Box 8, If checked, box 2 is trade or business income |

| 14 | marketGain | number (double) | Box 9, Market gain |

| 15 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 10-11, State tax withholding |

| 16 | secondTinNotice | boolean | Second TIN Notice |

Tax1099G Usage:

- TaxData tax1099G

FDX Data Structure as JSON

{

"tax1099G" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"payerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"payerTin" : "string",

"recipientTin" : "string",

"recipientNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"unemploymentCompensation" : 0.0,

"taxRefund" : 0.0,

"refundYear" : 0,

"federalTaxWithheld" : 0.0,

"rtaaPayments" : 0.0,

"grants" : 0.0,

"agriculturePayments" : 0.0,

"businessIncome" : true,

"marketGain" : 0.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 0.0,

"state" : "string",

"stateTaxId" : "string",

"stateIncome" : 0.0

} ],

"secondTinNotice" : true

}

}

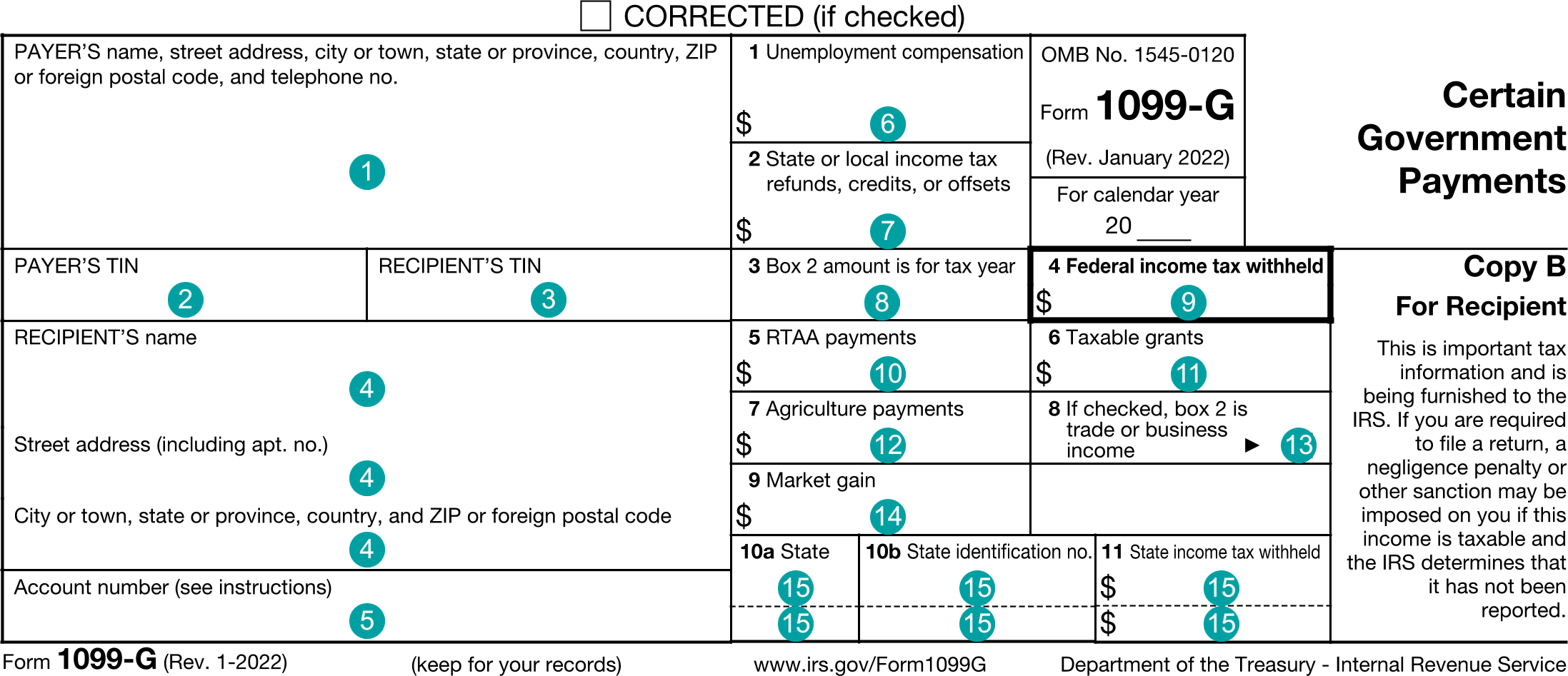

Example Form PDF

Example Form JSON

{

"tax1099G" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099G",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"payerTin" : "12-3456789",

"recipientTin" : "XXX-XX-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"accountNumber" : "123-1234567",

"unemploymentCompensation" : 1000.0,

"taxRefund" : 2000.0,

"refundYear" : 2019,

"federalTaxWithheld" : 400.0,

"rtaaPayments" : 500.0,

"grants" : 600.0,

"agriculturePayments" : 700.0,

"businessIncome" : true,

"marketGain" : 900.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 110.0,

"state" : "CA",

"stateTaxId" : "123-12345",

"stateIncome" : 1100.0

} ]

}

}

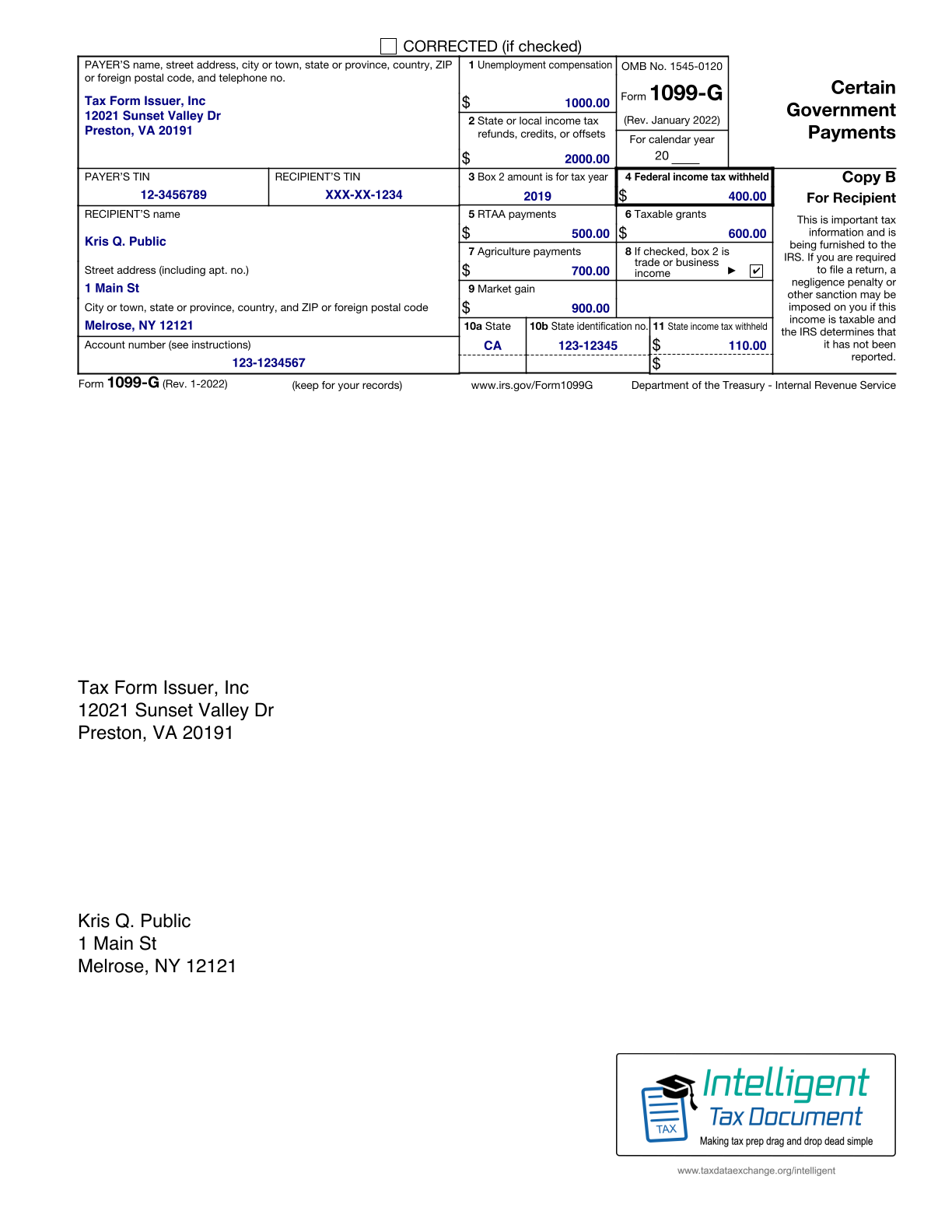

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1099G",

"payerNameAddress.line1": "12021 Sunset Valley Dr",

"payerNameAddress.city": "Preston",

"payerNameAddress.state": "VA",

"payerNameAddress.postalCode": "20191",

"payerNameAddress.name1": "Tax Form Issuer, Inc",

"payerTin": "12-3456789",

"recipientTin": "XXX-XX-1234",

"recipientNameAddress.line1": "1 Main St",

"recipientNameAddress.city": "Melrose",

"recipientNameAddress.state": "NY",

"recipientNameAddress.postalCode": "12121",

"recipientNameAddress.name1": "Kris Q. Public",

"accountNumber": "123-1234567",

"unemploymentCompensation": "1000.0",

"taxRefund": "2000.0",

"refundYear": "2019",

"federalTaxWithheld": "400.0",

"rtaaPayments": "500.0",

"grants": "600.0",

"agriculturePayments": "700.0",

"businessIncome": "true",

"marketGain": "900.0",

"stateTaxWithholding-1.stateTaxWithheld": "110.0",

"stateTaxWithholding-1.state": "CA",

"stateTaxWithholding-1.stateTaxId": "123-12345",

"stateTaxWithholding-1.stateIncome": "1100.0"

}

Issuer Instructions