Tax Data Exchange Ecosystem

We use the term Tax Data Exchange to describe an ecosystem of tax data communication.

Ecosystem Options

Ecosystem Participants

Is your company an ecosystem participant?

Complete this information sheet and get free advertising and resources.

The below describes what is and what should be.

1. Application Program Interfaces (API)

WHAT IS

Some tax document issuers sponsor an API server and interface with a limited number of tax software applications.

These tax document issuers use the older Open Financial Exchange (OFX) technology.

Some issuers have taxpayers enter their user account credentials into tax software in order to retrieve tax document data.

WHAT SHOULD BE

Tax document issuers who sponsor an API server should interface with the majority of tax software applications.

Taxpayers should not have to enter their account credentials into tax software in order to retrieve tax document data.

Tax document issuers should use the newer Financial Data Exchange (FDX) technology.

WHY?

Competition and Choice

Competition in the tax prep industry should be fostered to give taxpayers many tax prep options.

Security

The newer Financial Data Exchange (FDX) technology is more secure as it uses either OAuth technology or document-specific passwords.

Features

The financial Data Exchange (FDX) specification supports import of over 50 tax documents and is the future of Tax Data APIs.

2. Paper Tax Document Mailing

WHAT IS

Tax document issuers mail required tax documents to taxpayers.

Taxpayers do one of the following:

- Forward the paper tax document to their professional tax preparer

- Manually enter tax document data into tax software

- Scan the document with scanner or smartphone app, upload image to tax software or tax professional website for OCR (optical character recognition) processing

WHAT SHOULD BE

Tax document issuers mail tax documents to taxpayers and include QR codes on the recipient (for records) copy.

Taxpayers scan the QR code with smartphone app, uploads JSON to tax software or tax professional website for JSON parsing

WHY?

Manual data entry is:

- tedious

- error-prone

QR code scanning and JSON parsing is:

- far more reliable

- much simpler to implement

3. JSON File Download

WHAT IS

In addition to providing tax document PDF files, some issuers provide data files in Comma Separated Value (CSV) format or Tax Exchange Format (TXF).

If their tax software supports import of these data formats, taxpayer uploads these files into the software.

WHAT SHOULD BE

Issuers should provide data files in an industry-standard format such as FDX JSON.

Tax software apps should support import of industry-standards FDX JSON files.

WHY?

Few programs support import of proprietary CSV files.

Support for TXF import has dwindled and the TXF format is no longer maintained.

4. PDF File Download

WHAT IS

Tax document issuers make tax document PDF files available for download from a website.

Taxpayers do one of the following:

- Sign in to the website, download the PDF file, print to paper, and forward to their professional tax preparer

- Manually enter tax document data into tax software

- Upload PDF file to tax software or tax professional website for PDF parsing

WHAT SHOULD BE

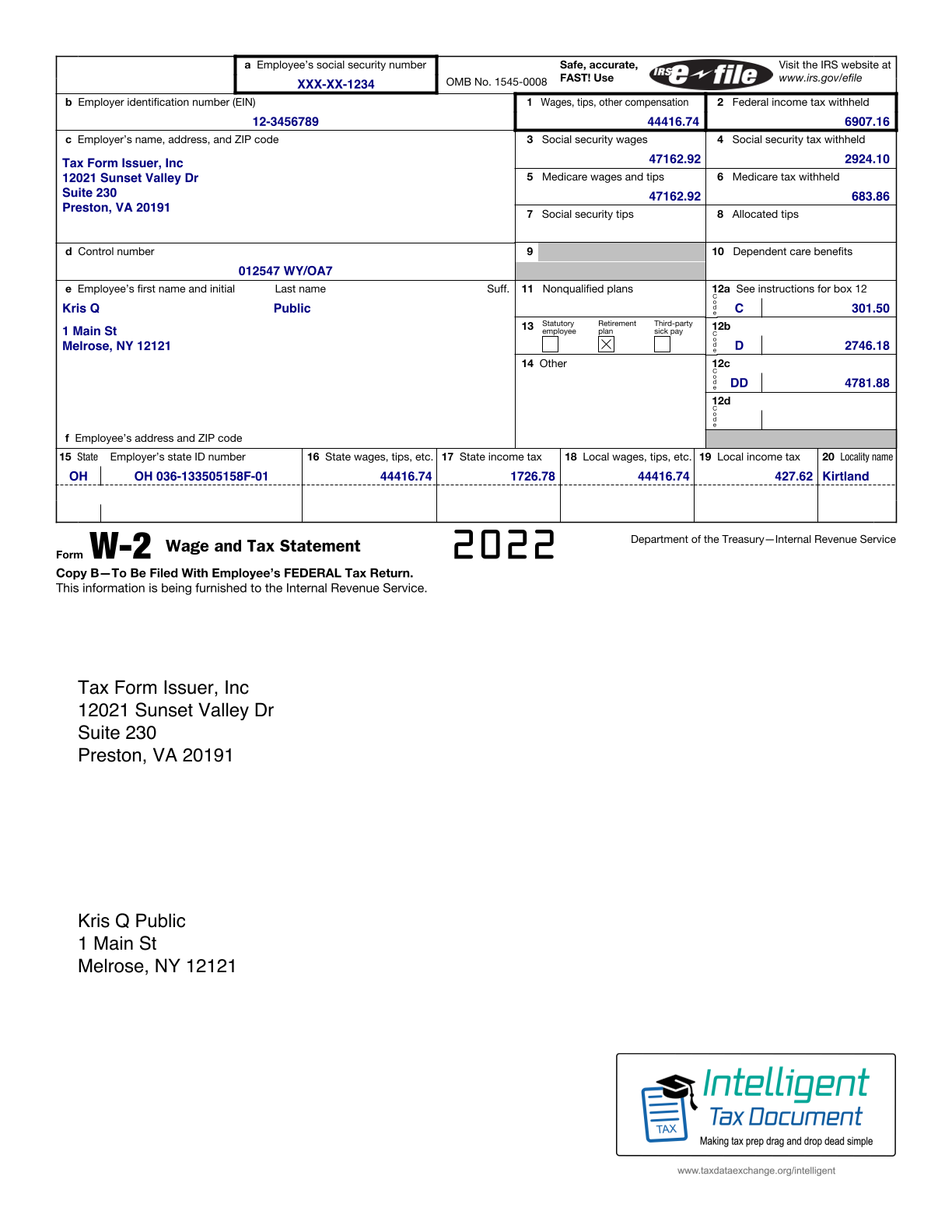

Tax document issuers make Intelligent Tax Document® files available for download from a website.

Taxpayers upload Intelligent Tax Document files to tax software or tax professional website for JSON extraction and parsing.

WHY?

JSON extraction and parsing is:

- more reliable

- simpler to implement