Tax Documents

Tax1098Q

FDX / Data Structures / Tax1098Q

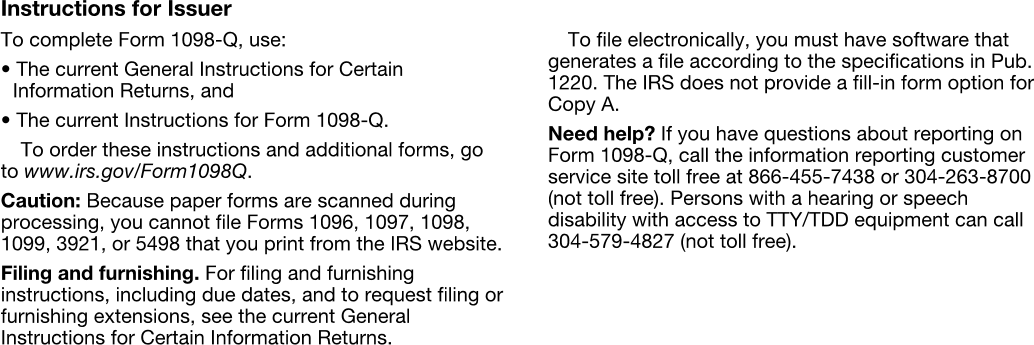

Form 1098-Q, Qualifying Longevity Annuity Contract Information

Extends and inherits all fields from Tax

Tax1098Q Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | issuerNameAddress | NameAddressPhone | ISSUER's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number |

| 2 | issuerTin | string | ISSUER's TIN |

| 3 | participantTin | string | PARTICIPANT'S TIN |

| 4 | participantNameAddress | NameAddress | PARTICIPANT'S name, street address (including apt. no.), city or town, state or province, country and ZIP or foreign postal code |

| 5 | accountNumber | string | Account number |

| 6 | planNumber | string | Plan number |

| 7 | planName | string | Plan name |

| 8 | planSponsorId | string | Plan sponsor's EIN |

| 9 | annuityAmount | number (double) | Box 1a, Annuity amount on start date |

| 10 | startDate | DateString | Box 1b, Annuity start date |

| 11 | canBeAccelerated | boolean | Box 2, Start date may be accelerated |

| 12 | totalPremiums | number (double) | Box 3, Total premiums |

| 13 | fairMarketValue | number (double) | Box 4, Fair market value of qualifying longevity annuity contract (FMV of QLAC) |

| 14 | premiums | Array of DateAmount | Box 5, Total monthly premiums paid for the contract and date of the last payment in the month |

Tax1098Q Usage:

- TaxData tax1098Q

FDX Data Structure as JSON

{

"tax1098Q" : {

"taxYear" : 0,

"corrected" : true,

"accountId" : "",

"taxFormId" : "",

"taxFormDate" : "2020-07-01",

"description" : "string",

"additionalInformation" : "string",

"taxFormType" : "BusinessIncomeStatement",

"attributes" : [ {

"name" : "string",

"value" : "string",

"boxNumber" : "string",

"code" : "string"

} ],

"error" : {

"code" : "string",

"message" : "string"

},

"issuerNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64",

"phone" : {

"type" : "HOME",

"country" : "string",

"number" : "string",

"extension" : "string"

}

},

"issuerTin" : "string",

"participantTin" : "string",

"participantNameAddress" : {

"line1" : "String64",

"line2" : "String64",

"line3" : "String64",

"city" : "String64",

"state" : "String64",

"postalCode" : "string",

"country" : "AD",

"name1" : "String64",

"name2" : "String64"

},

"accountNumber" : "string",

"planNumber" : "string",

"planName" : "string",

"planSponsorId" : "string",

"annuityAmount" : 0.0,

"startDate" : "2020-07-01",

"canBeAccelerated" : true,

"totalPremiums" : 0.0,

"fairMarketValue" : 0.0,

"premiums" : [ {

"date" : "2020-07-01",

"description" : "string",

"amount" : 0.0

} ]

}

}

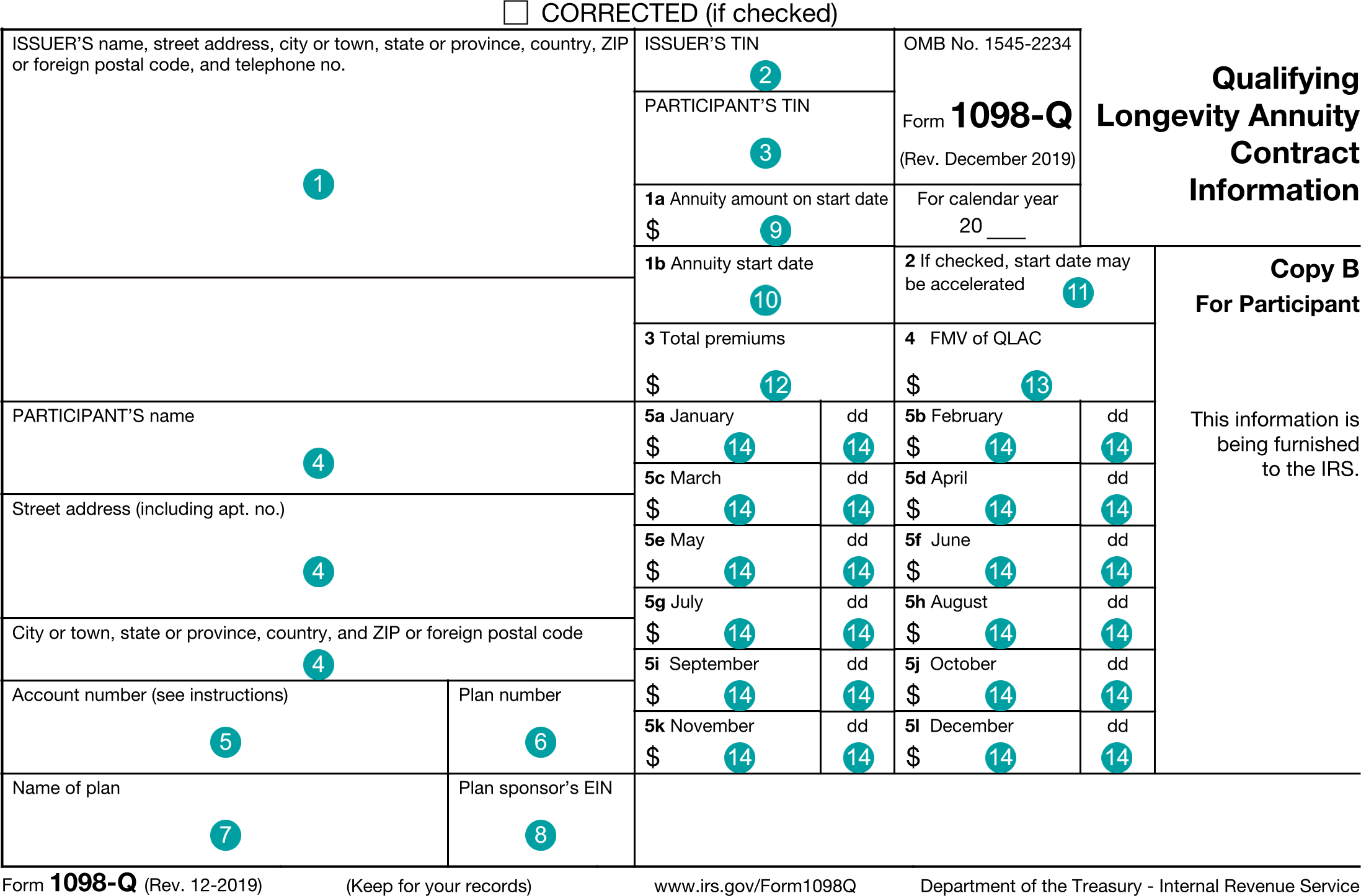

Example Form PDF

Example Form JSON

{

"tax1098Q" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1098Q",

"issuerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"issuerTin" : "12-3456789",

"participantTin" : "xxx-xx-1234",

"participantNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-55555555",

"planNumber" : "760-4517",

"planName" : "AAA QLAC Plans 4",

"planSponsorId" : "44-12345467",

"annuityAmount" : 8000.0,

"startDate" : "2020-07-01",

"canBeAccelerated" : true,

"totalPremiums" : 35000.0,

"fairMarketValue" : 48000.0,

"premiums" : [ {

"date" : "2020-01-10",

"amount" : 400.0

}, {

"date" : "2020-02-10",

"amount" : 400.0

}, {

"date" : "2020-03-10",

"amount" : 400.0

}, {

"date" : "2020-04-10",

"amount" : 400.0

}, {

"date" : "2020-05-10",

"amount" : 400.0

}, {

"date" : "2020-06-10",

"amount" : 400.0

}, {

"date" : "2020-07-10",

"amount" : 400.0

}, {

"date" : "2020-08-10",

"amount" : 400.0

}, {

"date" : "2020-09-10",

"amount" : 400.0

}, {

"date" : "2020-10-10",

"amount" : 400.0

}, {

"date" : "2020-11-10",

"amount" : 400.0

}, {

"date" : "2020-12-10",

"amount" : 400.0

} ]

}

}

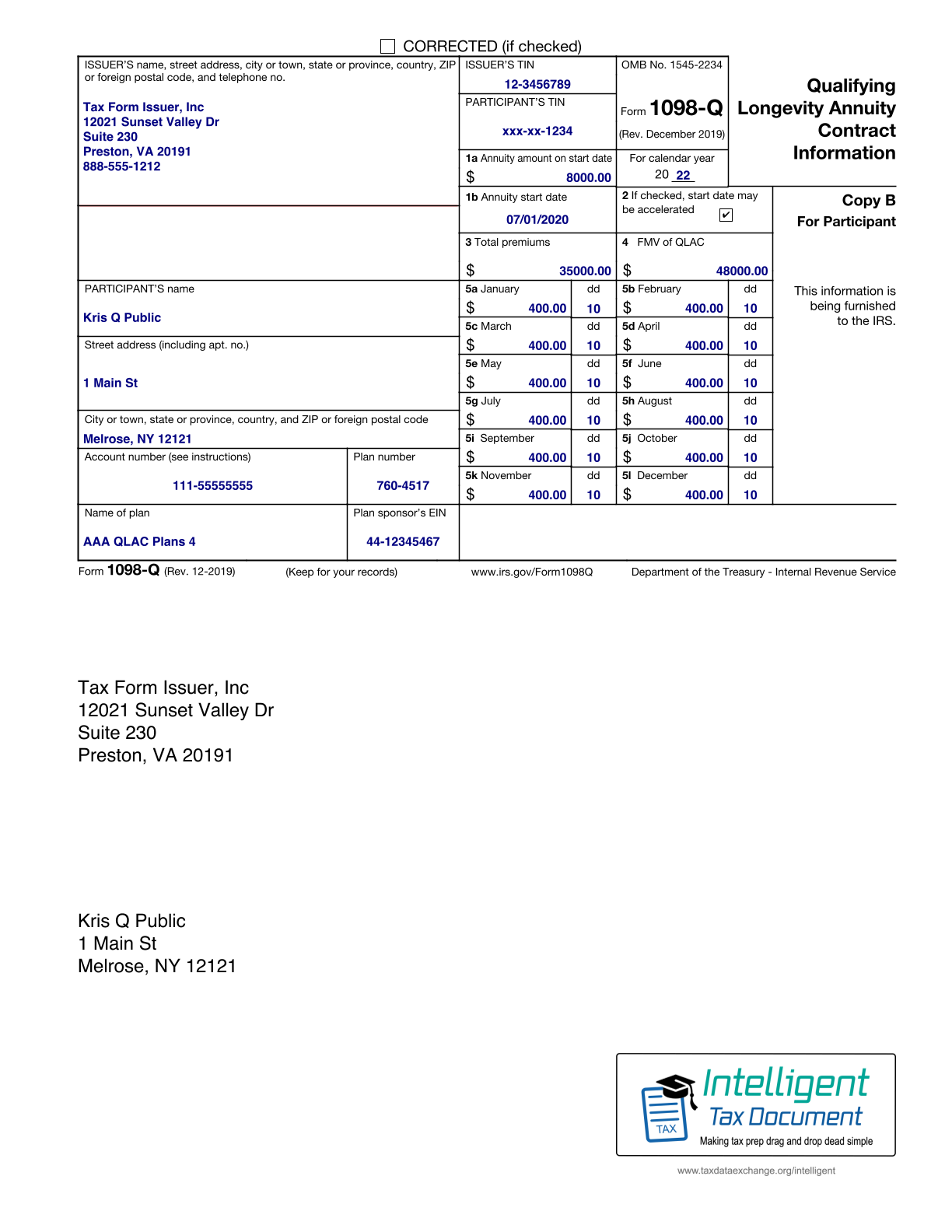

Example Form JSON for QR Code Purposes

Example Form PDF with QR Code

Example Data As Flattened Map (Key, Value Pairs)

{

"taxYear": "2022",

"taxFormDate": "2021-03-30",

"taxFormType": "Tax1098Q",

"issuerNameAddress.line1": "12021 Sunset Valley Dr",

"issuerNameAddress.line2": "Suite 230",

"issuerNameAddress.city": "Preston",

"issuerNameAddress.state": "VA",

"issuerNameAddress.postalCode": "20191",

"issuerNameAddress.country": "US",

"issuerNameAddress.name1": "Tax Form Issuer, Inc",

"issuerNameAddress.phone.number": "8885551212",

"issuerTin": "12-3456789",

"participantTin": "xxx-xx-1234",

"participantNameAddress.line1": "1 Main St",

"participantNameAddress.city": "Melrose",

"participantNameAddress.state": "NY",

"participantNameAddress.postalCode": "12121",

"participantNameAddress.country": "US",

"participantNameAddress.name1": "Kris Q Public",

"accountNumber": "111-55555555",

"planNumber": "760-4517",

"planName": "AAA QLAC Plans 4",

"planSponsorId": "44-12345467",

"annuityAmount": "8000.0",

"startDate": "2020-07-01",

"canBeAccelerated": "true",

"totalPremiums": "35000.0",

"fairMarketValue": "48000.0",

"premiums-1.date": "2020-01-10",

"premiums-1.amount": "400.0",

"premiums-2.date": "2020-02-10",

"premiums-2.amount": "400.0",

"premiums-3.date": "2020-03-10",

"premiums-3.amount": "400.0",

"premiums-4.date": "2020-04-10",

"premiums-4.amount": "400.0",

"premiums-5.date": "2020-05-10",

"premiums-5.amount": "400.0",

"premiums-6.date": "2020-06-10",

"premiums-6.amount": "400.0",

"premiums-7.date": "2020-07-10",

"premiums-7.amount": "400.0",

"premiums-8.date": "2020-08-10",

"premiums-8.amount": "400.0",

"premiums-9.date": "2020-09-10",

"premiums-9.amount": "400.0",

"premiums-10.date": "2020-10-10",

"premiums-10.amount": "400.0",

"premiums-11.date": "2020-11-10",

"premiums-11.amount": "400.0",

"premiums-12.date": "2020-12-10",

"premiums-12.amount": "400.0"

}

Issuer Instructions