1099-OID : Original Issue Discount

FDX

FDX / Data Structures / Tax1099Oid

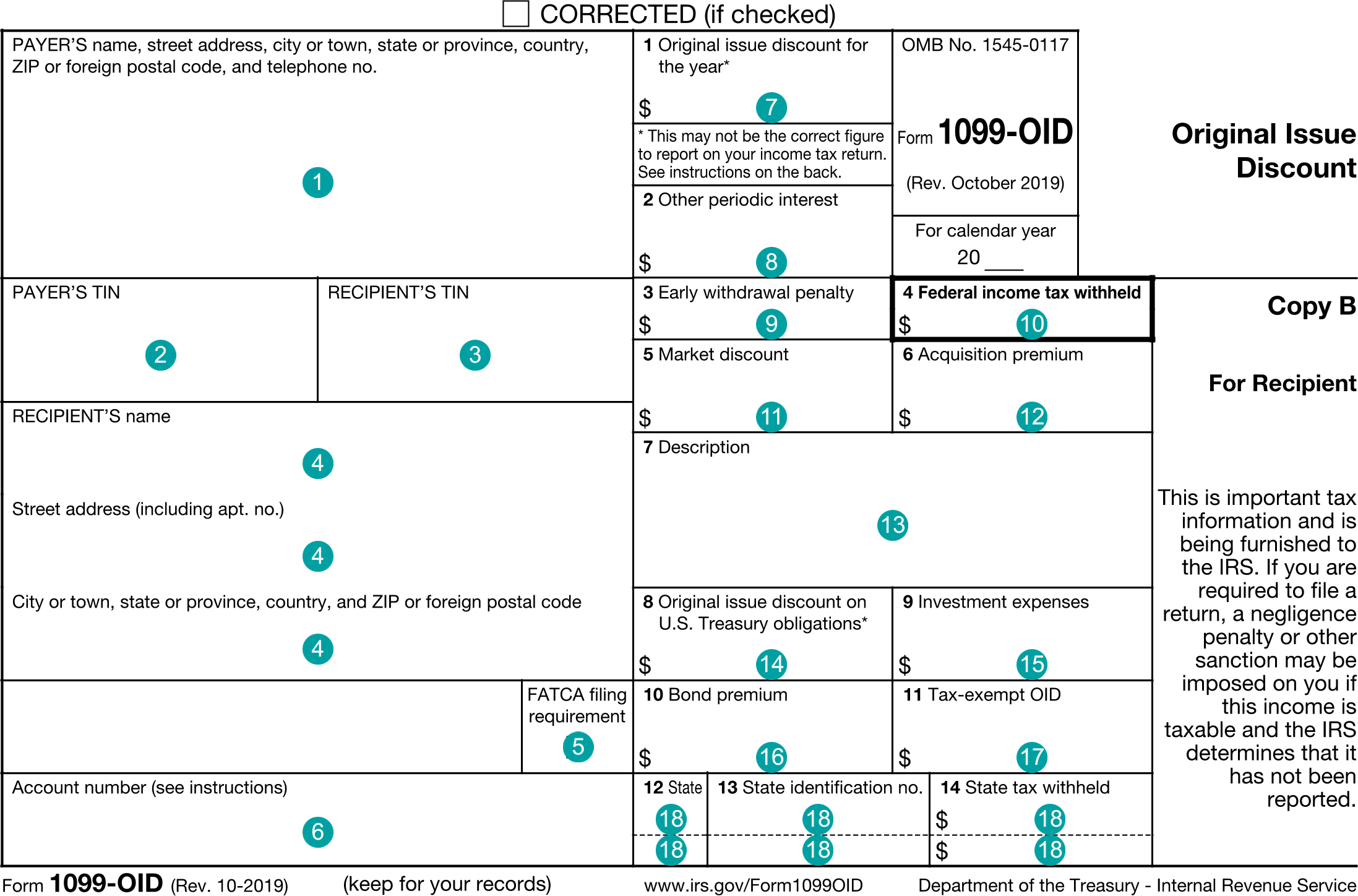

Form 1099-OID, Original Issue Discount

Extends and inherits all fields from Tax

Tax1099Oid Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | Payer's TIN |

| 3 | recipientTin | string | Recipient's TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 6 | accountNumber | string | Account number |

| 7 | originalIssueDiscount | number (double) | Box 1, Original issue discount |

| 8 | otherPeriodicInterest | number (double) | Box 2, Other periodic interest |

| 9 | earlyWithdrawalPenalty | number (double) | Box 3, Early withdrawal penalty |

| 10 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 11 | marketDiscount | number (double) | Box 5, Market discount |

| 12 | acquisitionPremium | number (double) | Box 6, Acquisition premium |

| 13 | oidDescription | string | Box 7, Description |

| 14 | discountOnTreasuryObligations | number (double) | Box 8, Original issue discount on U.S. Treasury obligations |

| 15 | investmentExpenses | number (double) | Box 9, Investment expenses |

| 16 | bondPremium | number (double) | Box 10, Bond premium |

| 17 | taxExemptOid | number (double) | Box 11, Tax-exempt OID |

| 18 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 12-14, State tax withheld |

| 19 | stateExemptOid | Array of DescriptionAmount | Supplemental: State name and tax-exempt OID by state |

| 20 | secondTinNotice | boolean | Second TIN Notice |

Tax1099Oid Usage:

- TaxData tax1099Oid

OFX

OFX / Types / Tax1099OID_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | ORIGISDISC | AmountType |

| 6 | OTHERPERINT | AmountType |

| 7 | ERLWITHPEN | AmountType |

| 8 | FEDTAXWH | AmountType |

| 9 | MARKETDISCOUNT | AmountType |

| 10 | ACQPREMIUM | AmountType |

| 11 | FORTAXPD | AmountType |

| 12 | FORCNT | GenericNameType |

| 13 | DESCRIPTION | LongMessageType |

| 14 | OIDONUSTRES | AmountType |

| 15 | INVESTEXP | AmountType |

| 16 | BONDPREMIUM | AmountType |

| 17 | TAXEXEMPTOID | AmountType |

| 18 | ORIGSTATE | OriginatingStateAggregate |

| 19 | PRIVACTBONDAMT | AmountType |

| 20 | PRIVACTBONDINT | RateType |

| 21 | STATECODE | StateCodeType |

| 22 | STATEIDNUM | IdType |

| 23 | STATETAXWHELD | AmountType |

| 24 | ADDLSTATETAXWHAGG | AddlStateTaxWheldAggregate |

| 25 | PAYERADDR | PayerAddress |

| 26 | PAYERID | GenericNameType |

| 27 | RECADDR | RecipientAddress |

| 28 | RECID | IdType |

| 29 | RECACCT | GenericNameType |

| 30 | TINNOT | BooleanType |

| 31 | FATCA | BooleanType |

Usages:

- Tax1099Response TAX1099OID_V100

FIRE

Under Development

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 657 | 1099-OID | 1099 OID | 1 | + |

| 661 | 1099-OID | Description | 2 | N/A |

| 658 | 1099-OID | Other periodic int,OID | 3 | + |

| 659 | 1099-OID | Early wdrawal pen, OID | 3 | - |

| 660 | 1099-OID | Fed tax wheld, OID | 3 | - |

| 662 | 1099-OID | OID, US treas obligl | 3 | + |

| 663 | 1099-OID | Investment Expense, OID | 3 | - |