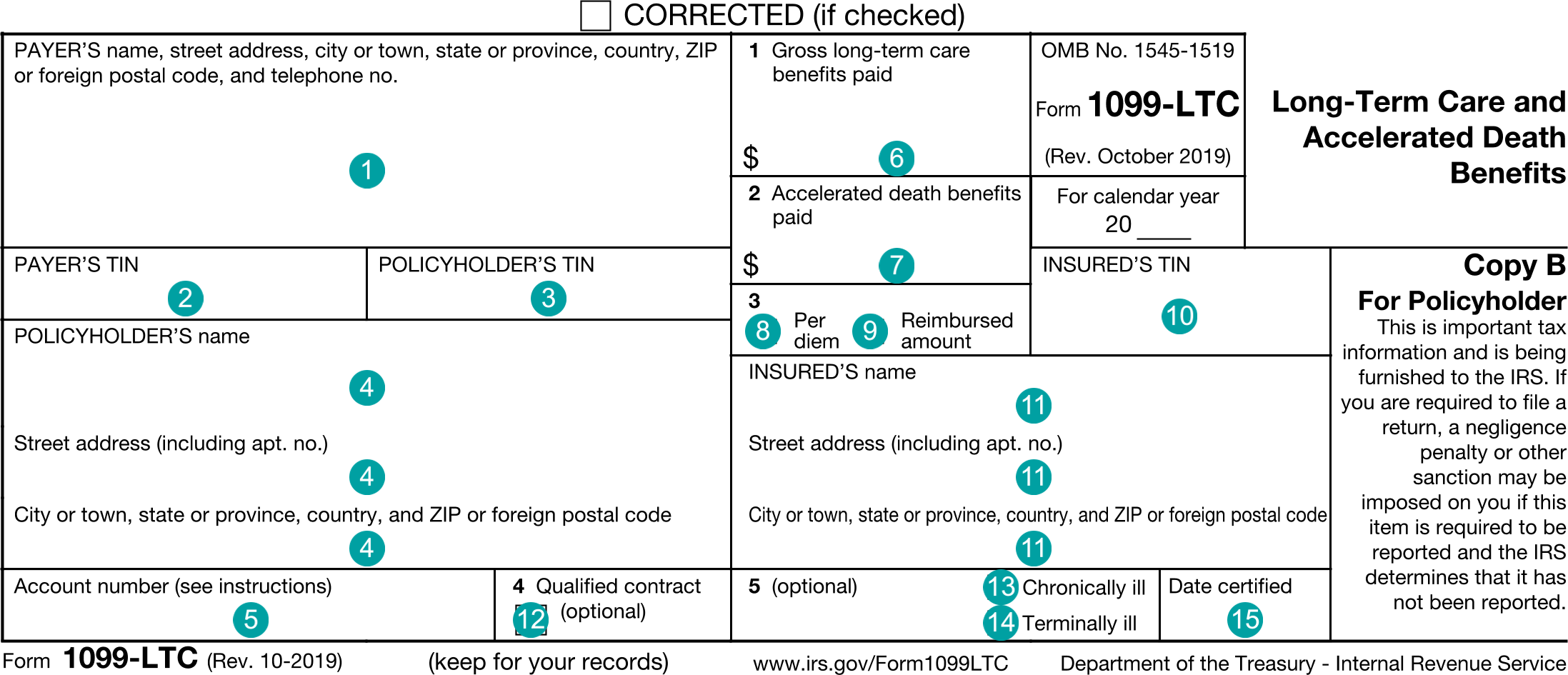

1099-LTC : Long-Term Care and Accelerated Death Benefits

FDX

FDX / Data Structures / Tax1099Ltc

Form 1099-LTC, Long-Term Care and Accelerated Death Benefits

Extends and inherits all fields from Tax

Tax1099Ltc Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | policyholderTin | string | POLICYHOLDER'S TIN |

| 4 | policyHolderNameAddress | NameAddress | Policyholder name and address |

| 5 | accountNumber | string | Account number |

| 6 | ltcBenefits | number (double) | Box 1, Gross long-term care benefits paid |

| 7 | deathBenefits | number (double) | Box 2, Accelerated death benefits paid |

| 8 | perDiem | boolean | Box 3, Per diem |

| 9 | reimbursedAmount | boolean | Box 3, Reimbursed amount |

| 10 | insuredId | string | INSURED'S taxpayer identification no. |

| 11 | insuredNameAddress | NameAddress | Insured name and address |

| 12 | qualifiedContract | boolean | Box 4, Qualified contract |

| 13 | chronicallyIll | boolean | Box 5, Chronically ill |

| 14 | terminallyIll | boolean | Box 5, Terminally ill |

| 15 | dateCertified | DateString | Date certified |

Tax1099Ltc Usage:

- TaxData tax1099Ltc

OFX

OFX / Types / Tax1099LTC_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | POLICYHOLDERADDR | PolicyholderAddressType |

| 6 | INSUREDADDR | InsuredAddressType |

| 7 | PAYERADDR | PayerAddressType |

| 8 | PAYERID | GenericNameType |

| 9 | POLICYHOLDERID | IdType |

| 10 | RECACCT | GenericNameType |

| 11 | LONGTERMBEN | AmountType |

| 12 | DEATHBEN | AmountType |

| 13 | PERDIEM | BooleanType |

| 14 | REIMB | BooleanType |

| 15 | INSUREDID | IdType |

| 16 | QUALCONTRACT | BooleanType |

| 17 | CHRONIC | BooleanType |

| 18 | TERMINAL | BooleanType |

| 19 | DATECERT | DateTimeType |

Usages:

- Tax1099Response TAX1099LTC_V100

FIRE

Under Development

TXF

The TXF standard does not support this form.