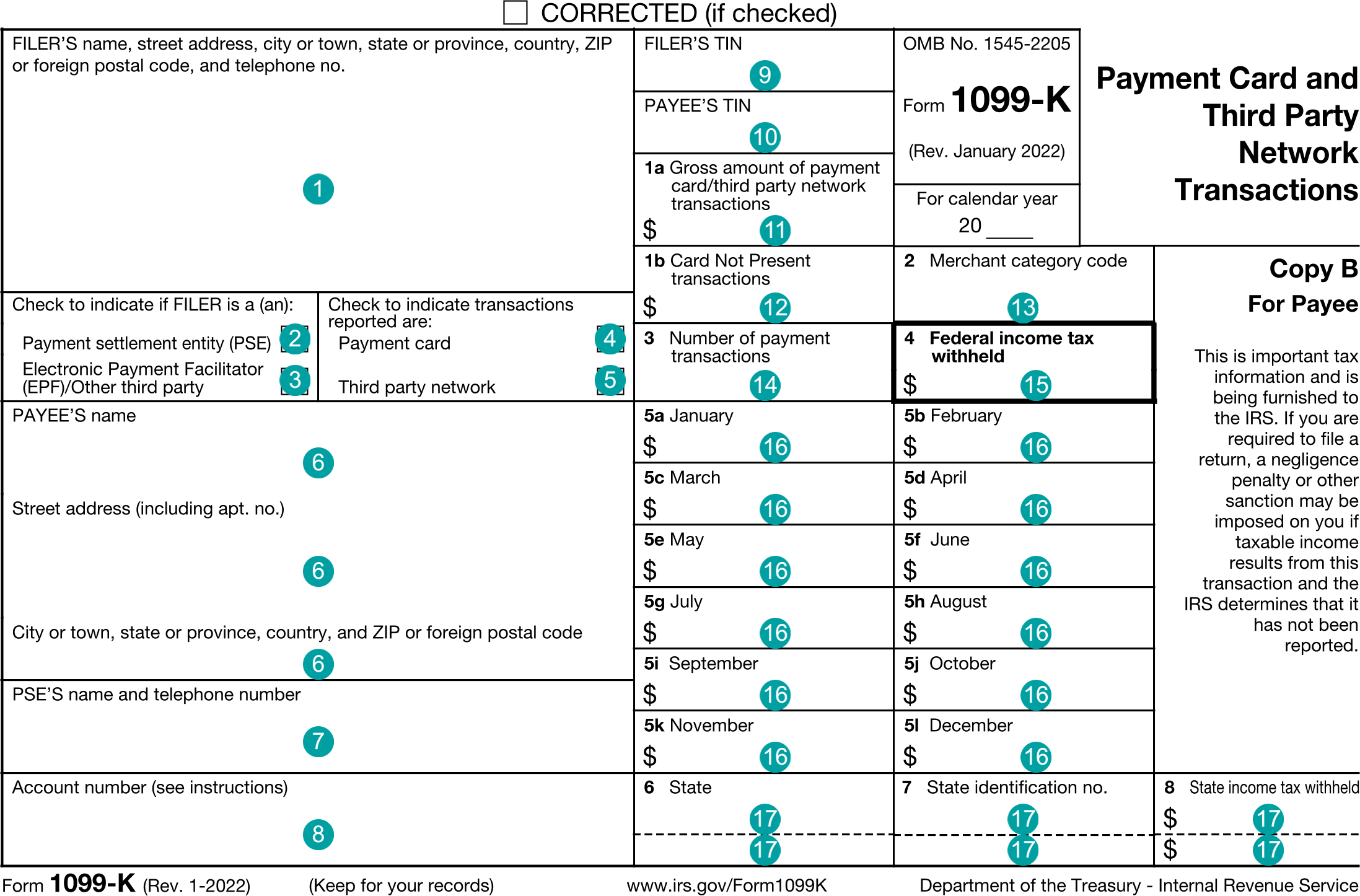

1099-K : Merchant Card and Third-Party Network Payments

FDX

FDX / Data Structures / Tax1099K

Form 1099-K, Merchant Card and Third-Party Network Payments

Extends and inherits all fields from Tax

Tax1099K Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | filerNameAddress | NameAddressPhone | Filer's name, address, and phone |

| 2 | paymentSettlementEntity | boolean | Check to indicate if FILER is a Payment Settlement Entity (PSE) |

| 3 | electronicPaymentFacilitator | boolean | Check to indicate if FILER is an Electronic Payment Facilitator (EPF) / Other third party |

| 4 | paymentCard | boolean | Check to indicate transactions reported are: Payment card |

| 5 | thirdPartyNetwork | boolean | Check to indicate transactions reported are: Third party network |

| 6 | payeeNameAddress | NameAddress | Payee's name and address |

| 7 | pseName | string | PSE's name |

| 8 | accountNumber | string | Account number |

| 9 | filerTin | string | FILER'S TIN |

| 10 | payeeTin | string | PAYEE'S TIN |

| 11 | grossAmount | number (double) | Box 1a, Gross amount of payment card/third party network transactions |

| 12 | cardNotPresent | number (double) | Box 1b, Card Not Present Transactions |

| 13 | merchantCategoryCode | string | Box 2, Merchant category code |

| 14 | numberOfTransactions | number (double) | Box 3, Number of purchase transactions |

| 15 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 16 | monthAmounts | Array of MonthAmount | Box 5, Monthly amounts |

| 17 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 6-8, State tax withholding |

| 18 | psePhone | TelephoneNumberPlusExtension | PSE's phone number |

| 19 | secondTinNotice | boolean | Second TIN Notice |

Tax1099K Usage:

- TaxData tax1099K

OFX

OFX / Types / Tax1099K_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYEEADDR | PayeeAddressType |

| 6 | FILERADDR | FilerAddressType |

| 7 | ADDLSTATETAXWHAGG | AddlStateTaxWheldAggregateType |

| 8 | PSE | BooleanType |

| 9 | EPF | BooleanType |

| 10 | PAYCARD | BooleanType |

| 11 | THIRDNET | BooleanType |

| 12 | ACCTNUM | GenericNameType |

| 13 | FILERID | GenericNameType |

| 14 | PAYEEID | IdType |

| 15 | GROSS | AmountType |

| 16 | CARDNOTPRESENT | AmountType |

| 17 | CATCODE | GenericNameType |

| 18 | NUMTRAN | GenericNameType |

| 19 | FEDTAXWH | AmountType |

| 20 | JAN | AmountType |

| 21 | FEB | AmountType |

| 22 | MAR | AmountType |

| 23 | APR | AmountType |

| 24 | MAY | AmountType |

| 25 | JUN | AmountType |

| 26 | JUL | AmountType |

| 27 | AUG | AmountType |

| 28 | SEP | AmountType |

| 29 | OCT | AmountType |

| 30 | NOV | AmountType |

| 31 | DEC | AmountType |

| 32 | PSENAME | GenericNameType |

| 33 | PSEPHONE | PhoneType |

Usages:

- Tax1099Response TAX1099K_V100

FIRE

Under Development

TXF

The TXF standard does not support this form.