Tax1120SK1_V100

OFX / Types / Tax1120SK1_V100

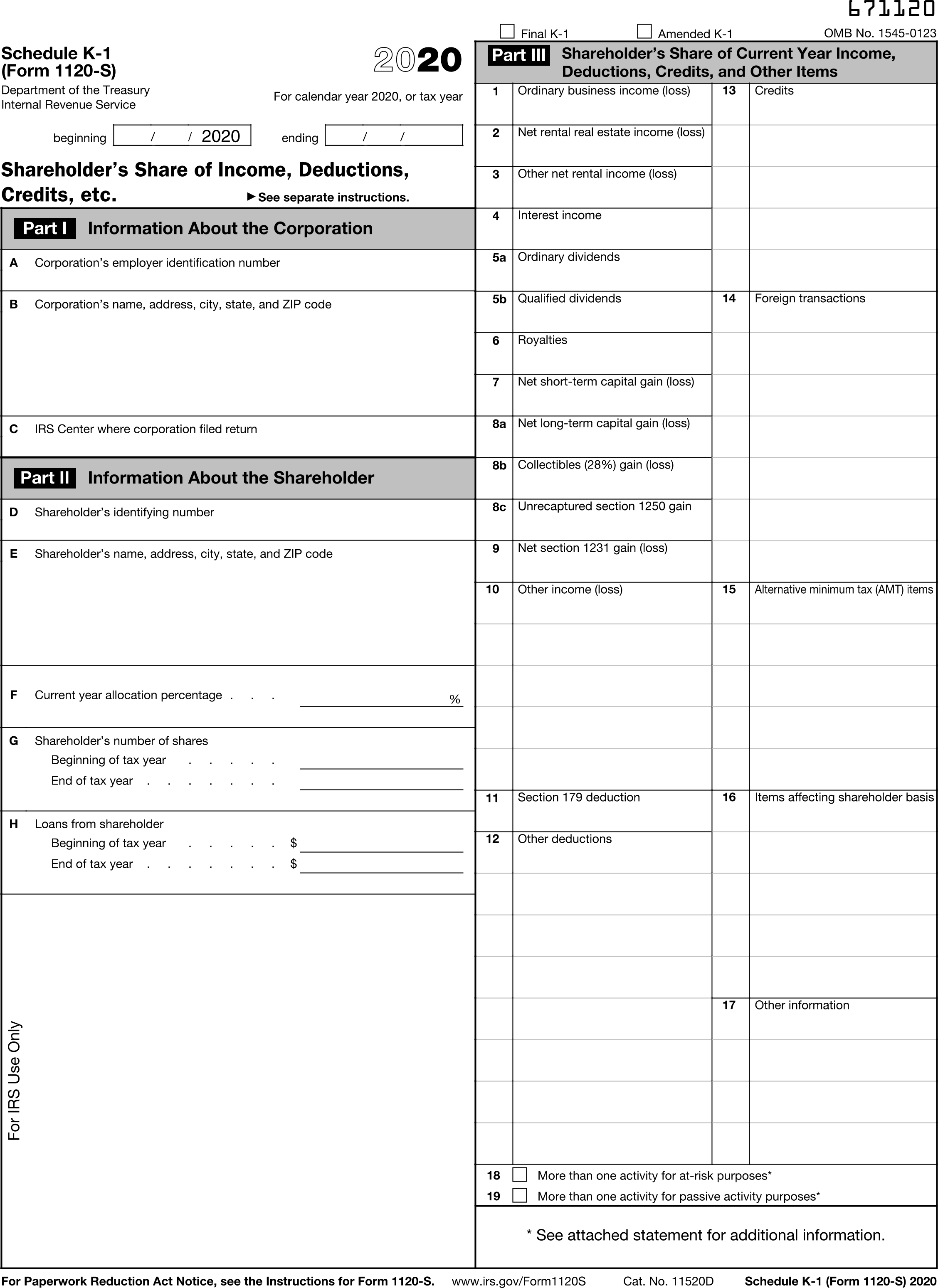

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FINALK1 | BooleanType |

| 6 | AMENDEDK1 | BooleanType |

| 7 | CORPNAME | GenericNameType |

| 8 | CORPEIN | GenericNameType |

| 9 | CORPADDRESS | anonymous complex type |

| 10 | IRSCENTER | GenericNameType |

| 11 | SHAREHOLDERID | GenericNameType |

| 12 | SHAREHOLDERNAME | GenericNameType |

| 13 | SHAREHOLDERADDRESS | anonymous complex type |

| 14 | PERCENTAGESTOCKOWNERSHIP | AmountType |

| 15 | SHARESBOY | AmountType |

| 16 | SHARESEOY | AmountType |

| 17 | LOANSBOY | AmountType |

| 18 | LOANSEOY | AmountType |

| 19 | ORDINARYINCOME | AmountType |

| 20 | NETRENTALREINCOME | AmountType |

| 21 | OTHERRENTALINCOME | AmountType |

| 22 | INTERESTINCOME | AmountType |

| 23 | ORDINARYDIVIDEND | AmountType |

| 24 | QUALIFIEDDIVIDEND | AmountType |

| 25 | ROYALTIES | AmountType |

| 26 | NETSTCAPITALGAIN | AmountType |

| 27 | NETLTCAPITALGAIN | AmountType |

| 28 | COLLECTIBLES | AmountType |

| 29 | UNRECAPSEC1250GAIN | AmountType |

| 30 | NETSEC1231GAIN | AmountType |

| 31 | OTHERINCOMELOSS | CodeAmountType |

| 32 | SEC179DEDUCT | AmountType |

| 33 | OTHERDEDUCTIONS | CodeAmountType |

| 34 | CREDITS | CodeAmountType |

| 35 | FOREIGNCOUNTRY | GenericNameType |

| 36 | FOREIGNTRANSACTIONS | CodeAmountType |

| 37 | AMTITEMS | CodeAmountType |

| 38 | ITEMSAFFECTINGSHAREHOLDERBASIS | CodeAmountType |

| 39 | OTHERINFO | CodeAmountType |

| 40 | FISCALYEARBEGIN | DateTimeType |

| 41 | FISCALYEAREND | DateTimeType |

| 42 | MULTIPLEATRISKACTIVITIES | BooleanType |

| 43 | MULTIPLEPASSIVEACTIVITIES | BooleanType |

Usages:

- TaxK1Response TAX1120SK1_V100

XSD

<xsd:complexType name="Tax1120SK1_V100"> <xsd:annotation> <xsd:documentation>The OFX element "TAX1120SK1_V100" is of type "Tax1120SK1_V100"</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxFormK1"> <xsd:sequence> <xsd:element name="FINALK1" type="ofx:BooleanType" minOccurs="0"/> <xsd:element name="AMENDEDK1" type="ofx:BooleanType" minOccurs="0"/> <xsd:element name="CORPNAME" type="ofx:GenericNameType"> <xsd:annotation> <xsd:documentation>Name of S-Corp</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="CORPEIN" type="ofx:GenericNameType"> <xsd:annotation> <xsd:documentation>Fed ID#</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="CORPADDRESS" minOccurs="0"> <xsd:complexType> <xsd:sequence> <xsd:element name="ADDR1" type="ofx:AddressType"/> <xsd:element name="ADDR2" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="ADDR3" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="CITY" type="ofx:AddressType"/> <xsd:element name="STATE" type="ofx:StateType"/> <xsd:element name="POSTALCODE" type="ofx:ZipType" minOccurs="0"/> <xsd:element name="PHONE" type="ofx:PhoneType" minOccurs="0"/> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:element name="IRSCENTER" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="SHAREHOLDERID" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="SHAREHOLDERNAME" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="SHAREHOLDERADDRESS" minOccurs="0"> <xsd:complexType> <xsd:sequence> <xsd:element name="ADDR1" type="ofx:AddressType"/> <xsd:element name="ADDR2" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="ADDR3" type="ofx:AddressType" minOccurs="0"/> <xsd:element name="CITY" type="ofx:AddressType"/> <xsd:element name="STATE" type="ofx:StateType"/> <xsd:element name="POSTALCODE" type="ofx:ZipType" minOccurs="0"/> <xsd:element name="PHONE" type="ofx:PhoneType" minOccurs="0"/> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:element name="PERCENTAGESTOCKOWNERSHIP" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box F, Current year allocation percentage. New description TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="SHARESBOY" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box G, Shareholder's number of shares, Beginning of tax year. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="SHARESEOY" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box G, Shareholder's number of shares, End of tax year. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="LOANSBOY" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box H, Loans from shareholder, Beginning of tax year. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="LOANSEOY" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box H, Loans from shareholder, End of tax year. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ORDINARYINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETRENTALREINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="OTHERRENTALINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="INTERESTINCOME" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="ORDINARYDIVIDEND" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="QUALIFIEDDIVIDEND" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="ROYALTIES" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETSTCAPITALGAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETLTCAPITALGAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="COLLECTIBLES" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="UNRECAPSEC1250GAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="NETSEC1231GAIN" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="OTHERINCOMELOSS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="SEC179DEDUCT" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="OTHERDEDUCTIONS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="CREDITS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="FOREIGNCOUNTRY" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="FOREIGNTRANSACTIONS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="AMTITEMS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="ITEMSAFFECTINGSHAREHOLDERBASIS" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="OTHERINFO" type="ofx:CodeAmountType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="FISCALYEARBEGIN" type="ofx:DateTimeType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Cleanup TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FISCALYEAREND" type="ofx:DateTimeType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Cleanup TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="MULTIPLEATRISKACTIVITIES" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 18, More than one activity for at-risk purposes. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="MULTIPLEPASSIVEACTIVITIES" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 19, More than one activity for passive activity purposes. TY19.</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAXK1MSGSRSV1>

<TAXK1TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAXK1RS>

<TAX1120SK1_V100>

<TAXYEAR>2020</TAXYEAR>

<FINALK1>Y</FINALK1>

<CORPNAME>American People Corp.</CORPNAME>

<CORPEIN>12-3456789</CORPEIN>

<CORPADDRESS>

<ADDR1>1718-1/2 Oak Blvd</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Austin</CITY>

<STATE>TX</STATE>

<POSTALCODE>78735</POSTALCODE>

</CORPADDRESS>

<IRSCENTER>Ogden</IRSCENTER>

<SHAREHOLDERID>xxx-xx-1234</SHAREHOLDERID>

<SHAREHOLDERNAME>Kris Q. Public</SHAREHOLDERNAME>

<SHAREHOLDERADDRESS>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</SHAREHOLDERADDRESS>

<PERCENTAGESTOCKOWNERSHIP>10.00</PERCENTAGESTOCKOWNERSHIP>

<ORDINARYINCOME>1015.00</ORDINARYINCOME>

<NETRENTALREINCOME>2016.00</NETRENTALREINCOME>

<OTHERRENTALINCOME>3017.00</OTHERRENTALINCOME>

<INTERESTINCOME>4018.00</INTERESTINCOME>

<ORDINARYDIVIDEND>5119.00</ORDINARYDIVIDEND>

<QUALIFIEDDIVIDEND>5220.00</QUALIFIEDDIVIDEND>

<ROYALTIES>6021.00</ROYALTIES>

<NETSTCAPITALGAIN>7022.00</NETSTCAPITALGAIN>

<NETLTCAPITALGAIN>8123.00</NETLTCAPITALGAIN>

<COLLECTIBLES>8224.00</COLLECTIBLES>

<UNRECAPSEC1250GAIN>8325.00</UNRECAPSEC1250GAIN>

<NETSEC1231GAIN>9026.00</NETSEC1231GAIN>

<OTHERINCOMELOSS>

<K1CODE>A</K1CODE>

<AMOUNT>10027.00</AMOUNT>

</OTHERINCOMELOSS>

<SEC179DEDUCT>11028.00</SEC179DEDUCT>

<OTHERDEDUCTIONS>

<K1CODE>A</K1CODE>

<AMOUNT>12029.00</AMOUNT>

</OTHERDEDUCTIONS>

<CREDITS>

<K1CODE>G</K1CODE>

<AMOUNT>13030.00</AMOUNT>

</CREDITS>

<FOREIGNCOUNTRY>Mexico</FOREIGNCOUNTRY>

<FOREIGNTRANSACTIONS>

<K1CODE>C</K1CODE>

<AMOUNT>14032.00</AMOUNT>

</FOREIGNTRANSACTIONS>

<AMTITEMS>

<K1CODE>D</K1CODE>

<AMOUNT>15033.00</AMOUNT>

</AMTITEMS>

<ITEMSAFFECTINGSHAREHOLDERBASIS>

<K1CODE>A</K1CODE>

<AMOUNT>16034.00</AMOUNT>

</ITEMSAFFECTINGSHAREHOLDERBASIS>

<OTHERINFO>

<K1CODE>A</K1CODE>

<AMOUNT>17035.00</AMOUNT>

</OTHERINFO>

<FISCALYEARBEGIN>20200101</FISCALYEARBEGIN>

<FISCALYEAREND>20201231</FISCALYEAREND>

</TAX1120SK1_V100>

</TAXK1RS>

</TAXK1TRNRS>

</TAXK1MSGSRSV1>

</OFX>

FDX JSON

{

"tax1120SK1" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1120SK1",

"finalK1" : true,

"fiscalYearBegin" : "2020-01-01",

"fiscalYearEnd" : "2020-12-31",

"corporationTin" : "12-3456789",

"corporationNameAddress" : {

"line1" : "1718-1/2 Oak Blvd",

"line2" : "Suite 230",

"city" : "Austin",

"state" : "TX",

"postalCode" : "78735",

"name1" : "American People Corp."

},

"irsCenter" : "Ogden",

"shareholderTin" : "xxx-xx-1234",

"shareholderNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"percentOwnership" : 10.0,

"beginningShares" : 110.0,

"endingShares" : 120.0,

"beginningLoans" : 1300.0,

"endingLoans" : 1400.0,

"ordinaryIncome" : 1015.0,

"netRentalRealEstateIncome" : 2016.0,

"otherRentalIncome" : 3017.0,

"interestIncome" : 4018.0,

"ordinaryDividends" : 5119.0,

"qualifiedDividends" : 5220.0,

"royalties" : 6021.0,

"netShortTermGain" : 7022.0,

"netLongTermGain" : 8123.0,

"collectiblesGain" : 8224.0,

"unrecaptured1250Gain" : 8325.0,

"net1231Gain" : 9026.0,

"otherIncome" : [ {

"code" : "A",

"amount" : 10027.0

} ],

"section179Deduction" : 11028.0,

"otherDeductions" : [ {

"code" : "A",

"amount" : 12029.0

} ],

"credits" : [ {

"code" : "G",

"amount" : 13030.0

} ],

"foreignTransactions" : [ {

"code" : "C",

"amount" : 14032.0

} ],

"foreignCountry" : "Mexico",

"amtItems" : [ {

"code" : "D",

"amount" : 15033.0

} ],

"basisItems" : [ {

"code" : "A",

"amount" : 16034.0

} ],

"otherInfo" : [ {

"code" : "A",

"amount" : 17035.0

} ],

"multipleAtRiskActivities" : true,

"multiplePassiveActivities" : false

}

}