Tax1099NEC_V100

OFX / Types / Tax1099NEC_V100

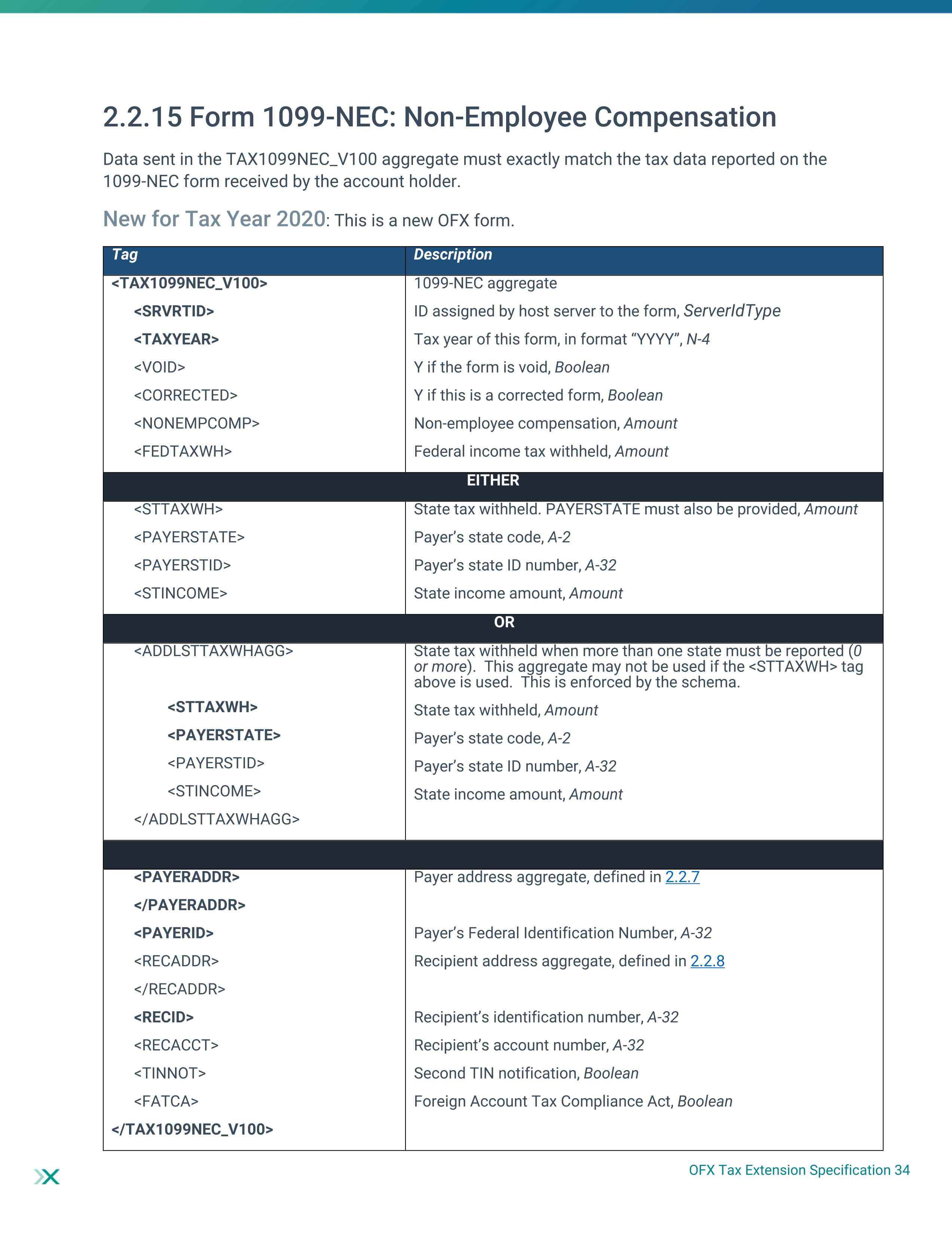

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | NONEMPCOMP | AmountType |

| 6 | FEDTAXWH | AmountType |

| 7 | STTAXWH | AmountType |

| 8 | PAYERSTATE | StateCodeType |

| 9 | PAYERSTID | IdType |

| 10 | STINCOME | AmountType |

| 11 | ADDLSTTAXWHAGG | AdditionalStateTaxWithheldAggregate |

| 12 | PAYERADDR | PayerAddress |

| 13 | PAYERID | GenericNameType |

| 14 | RECADDR | RecipientAddress |

| 15 | RECID | IdType |

| 16 | RECACCT | GenericNameType |

| 17 | TINNOT | BooleanType |

| 18 | FATCA | BooleanType |

Usages:

- Tax1099Response TAX1099NEC_V100

XSD

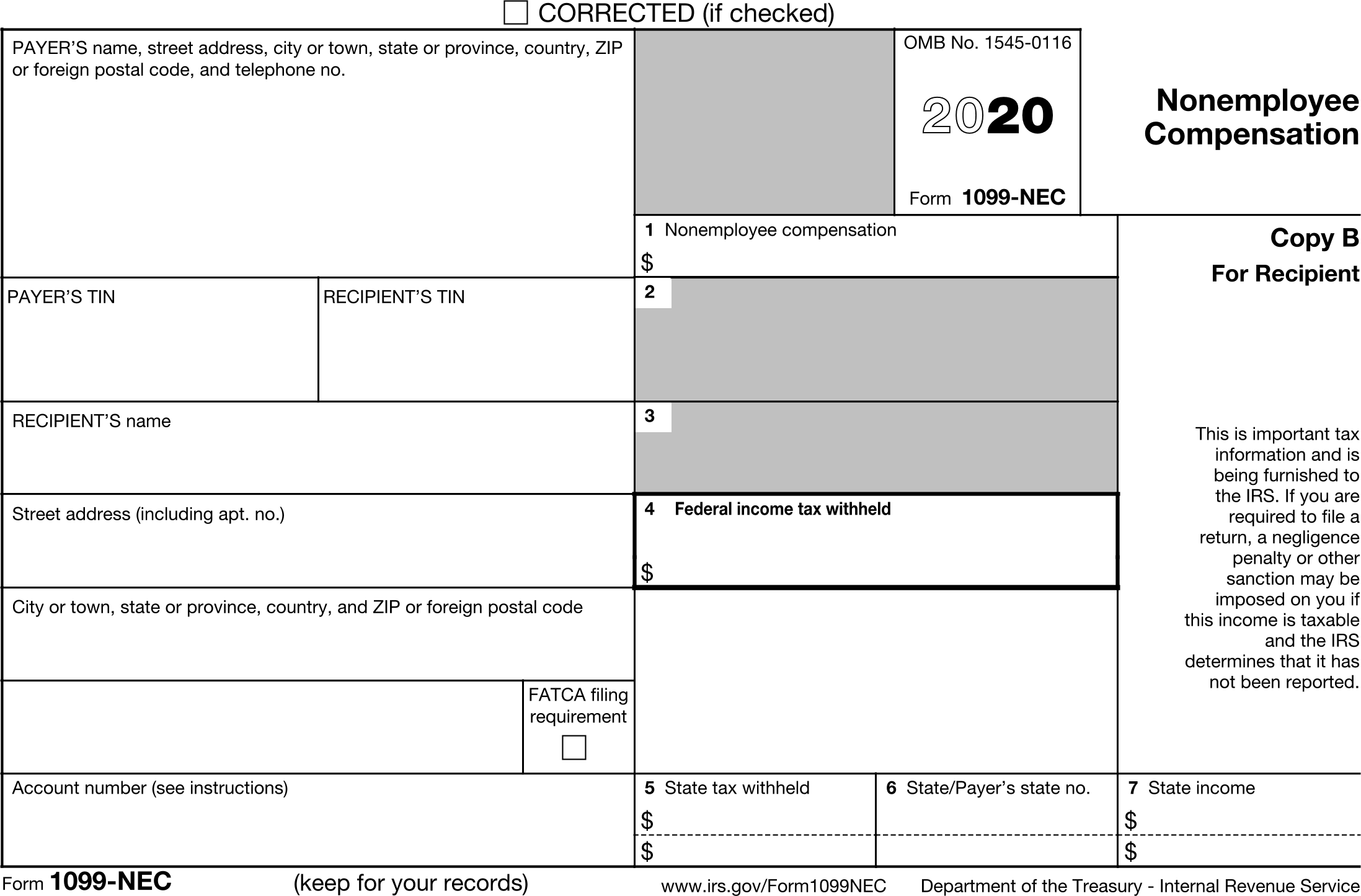

<xsd:complexType name="Tax1099NEC_V100"> <xsd:annotation> <xsd:documentation>Form 1099-NEC - Non-Employee Compensation. New TY20</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1099"> <xsd:sequence> <xsd:element name="NONEMPCOMP" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 1. Nonemployee compensation</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FEDTAXWH" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4. Federal income tax withheld</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:choice> <xsd:sequence> <xsd:element name="STTAXWH" type="ofx:AmountType" minOccurs="0"/> <xsd:element name="PAYERSTATE" type="ofx:StateCodeType" minOccurs="0"/> <xsd:element name="PAYERSTID" type="ofx:IdType" minOccurs="0"/> <xsd:element name="STINCOME" type="ofx:AmountType" minOccurs="0"/> </xsd:sequence> <xsd:element name="ADDLSTTAXWHAGG" type="ofx:AdditionalStateTaxWithheldAggregate" minOccurs="0" maxOccurs="unbounded"/> </xsd:choice> <xsd:element name="PAYERADDR" type="ofx:PayerAddress"/> <xsd:element name="PAYERID" type="ofx:GenericNameType"/> <xsd:element name="RECADDR" type="ofx:RecipientAddress" minOccurs="0"/> <xsd:element name="RECID" type="ofx:IdType"/> <xsd:element name="RECACCT" type="ofx:GenericNameType" minOccurs="0"/> <xsd:element name="TINNOT" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Second TIN Notice</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FATCA" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>FATCA filing requirement</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099NEC_V100>

<TAXYEAR>2020</TAXYEAR>

<NONEMPCOMP>1008.00</NONEMPCOMP>

<FEDTAXWH>4009.00</FEDTAXWH>

<ADDLSTTAXWHAGG>

<STTAXWH>5010.00</STTAXWH>

<PAYERSTID>xxx-123456</PAYERSTID>

<STINCOME>7010.00</STINCOME>

</ADDLSTTAXWHAGG>

<PAYERADDR>

<PAYERNAME1>Financial Data Exchange</PAYERNAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

</PAYERADDR>

<PAYERID>12-3456789</PAYERID>

<RECADDR>

<RECNAME1>Kris Q Public</RECNAME1>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</RECADDR>

<RECID>xxx-xx-1234</RECID>

<RECACCT>111-5555555</RECACCT>

</TAX1099NEC_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099Nec" : {

"taxYear" : 2021,

"taxFormDate" : "2022-02-01",

"additionalInformation" : "FDX v5.0",

"taxFormType" : "Tax1099Nec",

"payerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"payerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-5555555",

"nonEmployeeCompensation" : 1008.0,

"payerDirectSales" : false,

"federalTaxWithheld" : 4009.0,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 5010.0,

"state" : "NY",

"stateTaxId" : "xxx-123456",

"stateIncome" : 7010.0

} ]

}

}

OFX Tax Specification Page 34