Tax1097BTC_V100

OFX / Types / Tax1097BTC_V100

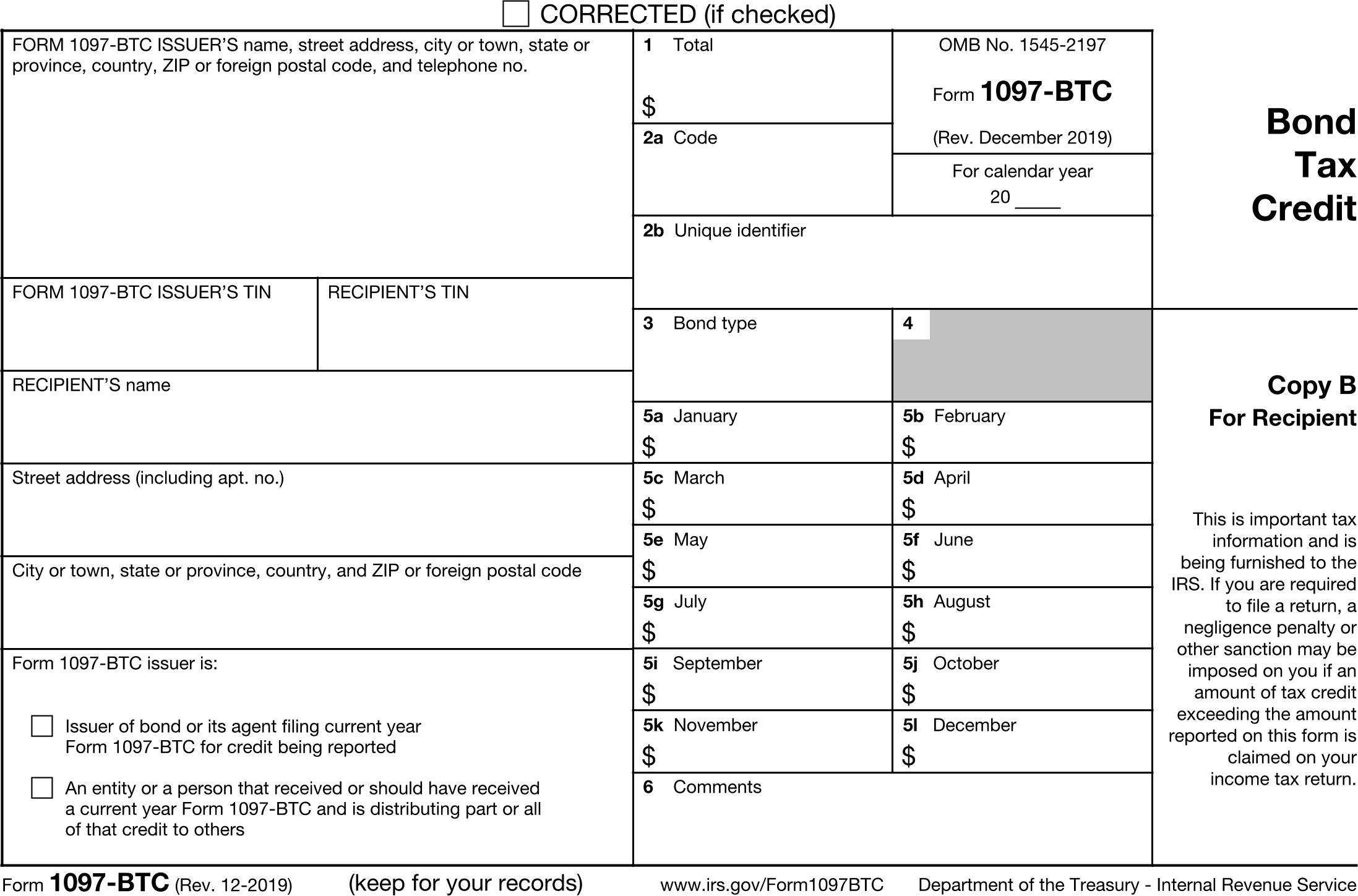

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | ISSUERADDR | Issuer1097AddressType |

| 6 | RECIPADDR | Recipient1097AddressType |

| 7 | ISSUERID | GenericNameType |

| 8 | RECIPID | IdType |

| 9 | BYISSUER | BooleanType |

| 10 | BYNOMINEE | BooleanType |

| 11 | TOTAL | AmountType |

| 12 | BONDCODE | GenericNameType |

| 13 | UNIQUEID | GenericNameType |

| 14 | BONDTYPE | GenericNameType |

| 15 | JAN | AmountType |

| 16 | FEB | AmountType |

| 17 | MAR | AmountType |

| 18 | APR | AmountType |

| 19 | MAY | AmountType |

| 20 | JUN | AmountType |

| 21 | JUL | AmountType |

| 22 | AUG | AmountType |

| 23 | SEP | AmountType |

| 24 | OCT | AmountType |

| 25 | NOV | AmountType |

| 26 | DEC | AmountType |

| 27 | COMMENTS | MessageType |

Usages:

- Tax1097Response TAX1097BTC_V100

XSD

<xsd:complexType name="Tax1097BTC_V100">

<xsd:annotation>

<xsd:documentation>Form 1097-BTC - Bond Tax Credit</xsd:documentation>

</xsd:annotation>

<xsd:complexContent>

<xsd:extension base="ofx:AbstractTaxForm1097Type">

<xsd:sequence>

<xsd:element name="ISSUERADDR" type="ofx:Issuer1097AddressType" minOccurs="0"/>

<xsd:element name="RECIPADDR" type="ofx:Recipient1097AddressType" minOccurs="0"/>

<xsd:element name="ISSUERID" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>FORM 1097-BTC ISSUER'S federal identification number</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="RECIPID" type="ofx:IdType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>RECIPIENT'S federal identification number</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="BYISSUER" type="ofx:BooleanType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Form 1097-BTC issuer is: Issuer of bond or its agent filing 2017 Form 1097-BTC for credit being reported</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="BYNOMINEE" type="ofx:BooleanType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Form 1097-BTC issuer is: An entity or a person that received or should have received a 2017 Form 1097-BTC and is distributing part or all of that credit to others</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="TOTAL" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 1. Total</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="BONDCODE" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 2a. Code</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="UNIQUEID" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 2b. Unique Identifier</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="BONDTYPE" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 3. Bond type</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="JAN" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5a. January</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="FEB" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5b. February</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="MAR" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5c. March</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="APR" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5d. April</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="MAY" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5e. May</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="JUN" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5f. June</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="JUL" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5g. July</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="AUG" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5h. August</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="SEP" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5i. September</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="OCT" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5j. October</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="NOV" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5k. November</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="DEC" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 5l. December</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="COMMENTS" type="ofx:MessageType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 6. Comments</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1097MSGSRSV1>

<TAX1097TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1097RS>

<TAX1097BTC_V100>

<TAXYEAR>2020</TAXYEAR>

<ISSUERADDR>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

<ISSUERNAME1>Financial Data Exchange</ISSUERNAME1>

</ISSUERADDR>

<RECIPADDR>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<RECIPNAME1>Kris Q Public</RECIPNAME1>

</RECIPADDR>

<ISSUERID>12-3456789</ISSUERID>

<RECIPID>xxx-xx-1234</RECIPID>

<BYISSUER>Y</BYISSUER>

<BYNOMINEE>Y</BYNOMINEE>

<TOTAL>1007.00</TOTAL>

<BONDCODE>123-456-789</BONDCODE>

<UNIQUEID>guid-54321</UNIQUEID>

<BONDTYPE>BondType</BONDTYPE>

<JAN>511.00</JAN>

<FEB>496.00</FEB>

<MAR></MAR>

<APR></APR>

<MAY></MAY>

<JUN></JUN>

<JUL></JUL>

<AUG></AUG>

<SEP></SEP>

<OCT></OCT>

<NOV></NOV>

<DEC></DEC>

<COMMENTS>6. Comments</COMMENTS>

</TAX1097BTC_V100>

</TAX1097RS>

</TAX1097TRNRS>

</TAX1097MSGSRSV1>

</OFX>

FDX JSON

{

"tax1097Btc" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1097Btc",

"issuerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"issuerTin" : "12-3456789",

"recipientTin" : "xxx-xx-1234",

"recipientNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"filingForCredit" : true,

"asNominee" : true,

"total" : 1007.0,

"bondCode" : "123-456-789",

"uniqueId" : "guid-54321",

"bondType" : "BondType",

"amounts" : [ {

"month" : "JAN",

"amount" : 511.0

}, {

"month" : "FEB",

"amount" : 496.0

} ],

"comments" : "6. Comments"

}

}